XAUUSD trades near record highs amid U.S. shutdown fears and strong Fed cut expectations. Watch key zones at $3,900 and $3,800 for the next move.

- Gold remains strong near record highs, backed by safe-haven demand and expectations of U.S. Fed rate cuts.

- The U.S. government shutdown and weaker U.S. dollar are adding fuel to the rally.

- Technicals show overbought conditions; a pullback to $3,839 or $3,787 is possible.

- A daily close above $3,900 may open a path toward $4,000.

- Key fundamental drivers: Fed policy, inflation, USD strength, geopolitics, central bank demand.

Gold (XAUUSD) has surged again, breaking past $3,800 and touching fresh records. Reuters

The U.S. government shutdown has stirred uncertainty, pushing investors toward safe-haven assets. Meanwhile, expectations that the Fed will continue trimming rates bolster gold’s appeal. Reuters

Still, the rally is not without resistance. The U.S. dollar is showing signs of rebound, and overbought technical indicators suggest that gold may need a rest or pullback before continuing upward.

Technical Setup – Overbought, Pullback Zones & Breakout Levels

On the chart, the 14-day RSI remains in bullish territory (around 64), indicating strong momentum. FxStreet . Gold currently trades above its 21-SMA and 50-SMA, with immediate resistance near $3,950 and the psychological zone around $4,000.

Should gold face a retracement, initial support lies at $3,839 (near 21-SMA). Below that, $3,787 (50-SMA) and deeper toward $3,720 (100-SMA) are possible zones for buying interest.

A clean daily close above $3,900 would shift bias toward bulls aiming for $4,000+.

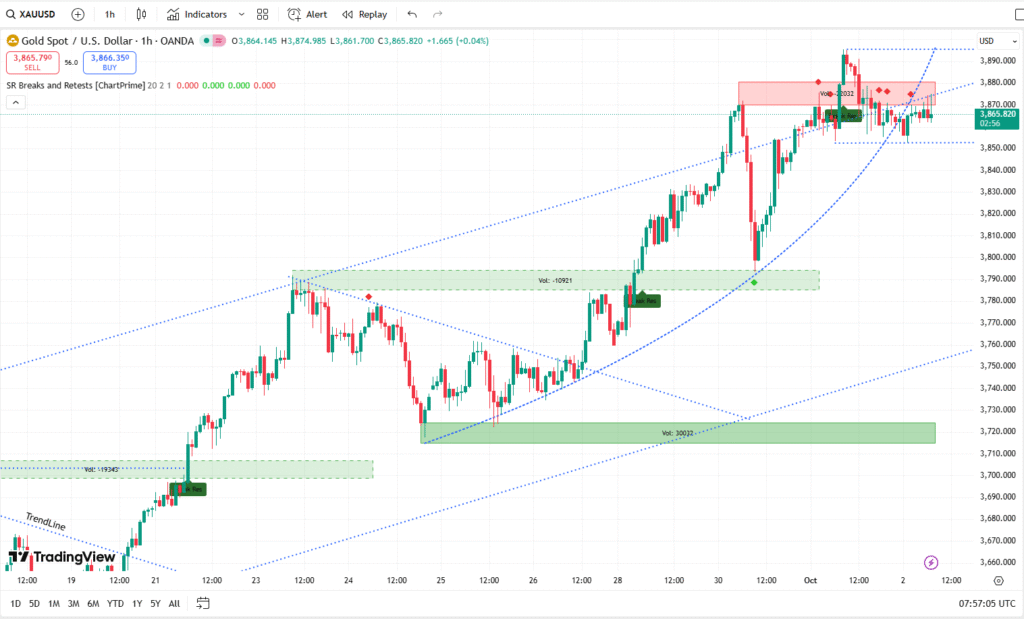

Technical Observations (XAUUSD 1H Chart)

- Trend: Strong uptrend, making higher highs and higher lows.

- Support Zones:

- 3820 – 3840 (nearest strong support)

- 3780 – 3800 (major support zone)

- Resistance Zone:

- 3875 – 3890 (short-term resistance)

- Price Action: Currently consolidating inside the red zone (3865 – 3875). Breakout above this could continue the bullish trend.

Short-Term Forecast (1–3 Days)

- If price closes above 3868–3875 (H1 candle) → bullish continuation.

- If price closes below 3845 (H1 candle) → bearish correction possible.

Bullish Setup

- Entry (Buy): 3866 – 3870 (after H1 close above resistance)

- Take Profit (TP):

- TP1 → 3890

- TP2 → 3910

- Stop Loss (SL): Below 3845

Bearish Setup (if breakout fails)

- Entry (Sell): If H1 closes below 3845

- Take Profit (TP):

- TP1 → 3820

- TP2 → 3790

- Stop Loss (SL): Above 3868

Summary:

- Above 3868 = Buy opportunity (trend continuation).

- Below 3845 = Sell opportunity (correction).

- Right now, trend is bullish but near resistance → better to wait for breakout confirmation.

XAUUSD (H1 Chart) Support & Resistance Table

| Level Type | Price Zone (USD) | Notes |

|---|---|---|

| Resistance 2 | 3890 – 3910 | Strong upper resistance, TP zone if bullish breakout continues |

| Resistance 1 | 3868 – 3875 | Current short-term resistance (price consolidating here) |

| Support 1 | 3820 – 3840 | Nearest support, buyers may step in here |

| Support 2 | 3780 – 3800 | Stronger support zone, possible reversal area |

| Support 3 | 3710 – 3730 | Major support zone, last defense for bulls |

Summary:

- Key resistance to watch: 3868 – 3875 (if broken, target 3890–3910).

- Key support to watch: 3820 – 3840 (if broken, trend may weaken).

Today’s XAU/USD Forecast

- A retest toward 3839 – 3787 (support zones) is possible; traders should watch for bullish reversal signals in these areas.

- If support holds, gold may attempt a push above 3900, opening the door toward 3910+.

- In the short term, gold could range between 3850 – 3930 until a decisive breakout or breakdown occurs.

Summary:

- Above 3875 = bullish continuation toward 3890 – 3910.

- Below 3840 = correction toward 3820 / 3800 zones.

- Current range for today: 3850 – 3930.

Fundamental Risks

- Fed & Inflation: Any unexpected hawkish tone or stronger inflation print could revive USD strength and pressure gold.

- Shutdown Uncertainty: Further delays to U.S. economic data (jobs, inflation, GDP) may raise doubts over Fed timing.

- Yield & Dollar Moves: Rising U.S. Treasury yields make gold less attractive.

- Jewelry Demand / Physical Side: High gold prices may slow demand in India/China.

- Geopolitics & Central Bank Buying: Continued tensions and reserves accumulation provide tailwinds.

The XAUUSD rally is alive and strong, driven by dovish Fed expectations, safe-haven flows, and U.S. shutdown uncertainty. However, overbought technicals and USD resilience pose real threats. Traders should watch $3,839 – $3,787 for support and aim for $3,900+ breakout for further upside. Tight risk control is essential.

FAQs

- Is gold’s rally sustainable?

It has strong support from fundamental drivers, but overbought technicals suggest some rest or pullback is possible. - What happens if $3,900 breaks?

A sustained close above $3,900 opens the path to $3,950 and then possibly $4,000. - Where will gold find support on a dip?

Primary support is at $3,839 (21-SMA), then $3,787 (50-SMA), and deeper at $3,720. - How does the U.S. shutdown impact gold?

It delays data releases, increases uncertainty, weakens USD, and boosts safe-haven demand for gold. - Which data can move gold next?

U.S. inflation (PCE), employment (NFP, ADP), Fed speeches, and yield moves. - Should I trade now or wait for confirmation?

Conservative traders wait for a breakout above $3,900 or a bounce from support zones. Aggressive traders may enter early but use tight stops.

Disclaimer

This article is for educational purposes only and does not constitute financial or investment advice. Trading gold, forex, or commodities involves high risk, and past performance does not guarantee future results. Always do your own analysis or consult a qualified financial advisor before trading.