Key Points

- Gold holds firm above $4,000 as traders eye U.S. inflation data, Fed signals, and the prolonged government shutdown for direction.

- Despite overbought conditions, the broader trend remains bullishly intact, with key support at $3,970–$3,950 and upside targets at $4,100–$4,150.

- Delays in economic data and a softer U.S. dollar continue to boost safe-haven demand, keeping gold’s momentum strong heading into next week.

Overview

Gold (XAU/USD) continues to climb beyond the historic $4,000 mark, extending one of its strongest bullish runs in recent memory.

This week, traders are watching three key factors:

U.S. inflation data, the Federal Reserve’s latest tone, and the ongoing government shutdown.

Together, these catalysts could decide whether the current “shallow correction” remains contained or evolves into a deeper retracement.

Market participants are closely following bond yields, Treasury market flows, and signals from Core CPI and PPI.

Despite overbought readings on the Relative Strength Index (RSI) and extended distance from EMA50/EMA200, institutional demand through gold ETFs and persistent safe-haven flows continue to support the metal.

Government Shutdown Extends – Impact on Gold Market Timing

The U.S. government shutdown, now stretching into its second week, has created uncertainty across global markets.

With key economic reports delayed, including inflation and jobs data, the Federal Reserve faces limited visibility for near-term policy decisions.

This lack of clarity has opened the door for gold to gain further momentum, as investors seek refuge from political and economic instability.

If the deadlock persists, expect safe-haven demand to remain a major pillar of support for XAU/USD.

Gold Price Hits New All-Time High Above $4,000

Gold recently shattered its all-time high, trading above $4,000 per ounce for the first time ever — a symbolic and psychological milestone for global investors.

According to recent market reports, the surge has been fueled by a mix of inflation concerns, Fed easing expectations, and strong central-bank purchases.( Reuters )

However, analysts caution that while momentum remains strong, the metal could see bouts of volatility if risk appetite improves or if profit-taking accelerates near the top.

Still, gold’s long-term outlook remains positive, supported by a weaker U.S. dollar, declining bond yields, and persistent geopolitical uncertainty.( FxStreet )

Gold Forecast Summary: Scenarios for the Week Ahead

As gold (XAU/USD) continues its march above $4,000, the week ahead may decide whether this momentum can hold or if a modest pullback takes shape. Key drivers include delayed U.S. inflation data, evolving signals from Federal Reserve officials, and the prolonged government shutdown, all of which cloud timing for breakthroughs or pauses. Should data undershoot expectations, gold could extend gains, but a hawkish turn from the Fed or surprise upside in CPI/PPI could force a sharper correction. Traders will also watch bond yields, market sentiment flows into gold ETFs, and technical tension at RSI / EMA bands for early signs of reversal.

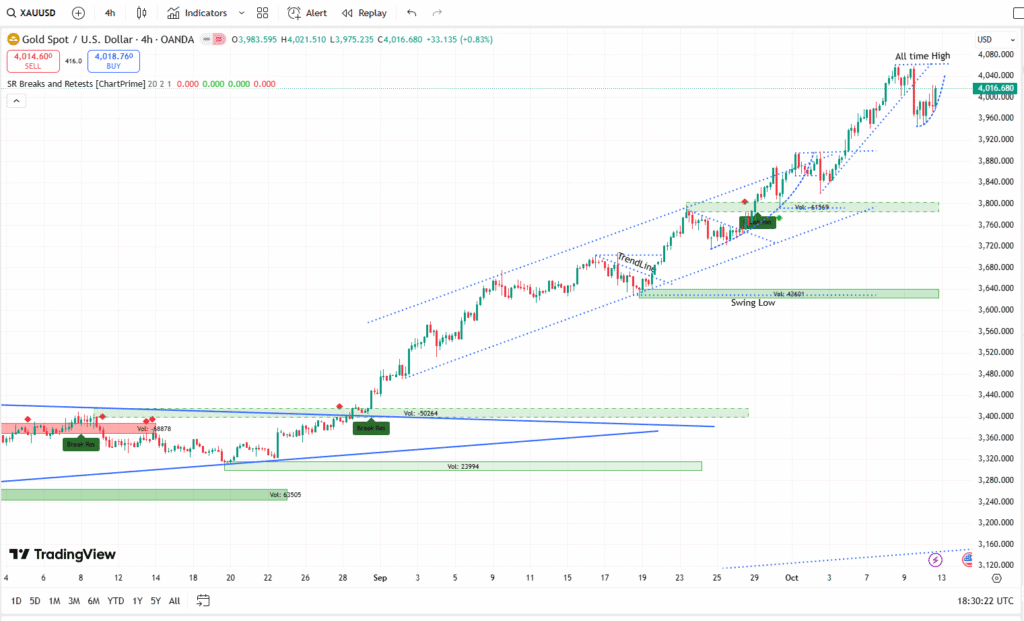

Gold Technical Forecast: Price Consolidates Below Record High, Trend Still Bullish

On the technical front, gold is consolidating just under its record high near $4,060, forming a narrow sideways range on the 4-hour and daily charts.

Despite temporary pauses, trend structure remains bullish, with the price holding firmly above the $3,970–$3,950 support zone.

The RSI has cooled slightly from overbought levels, suggesting healthy profit-taking rather than trend exhaustion.

As long as gold maintains closes above EMA50 ($3,980), the bias remains upward, with potential continuation toward $4,100–$4,150 in the next leg higher.

XAU/USD Weekly Outlook: Minor Pullback Seen Before Next Upside Leg

Gold traders are observing a mild pullback after the breakout, largely due to position adjustments ahead of the upcoming U.S. CPI data.

Momentum remains constructive: dips continue to attract buying interest, while volume spikes confirm active accumulation by institutional traders.

Unless the U.S. Dollar Index (DXY) stages a sharp recovery above 100.50, the downside in gold appears limited.

In this context, the current correction phase is better viewed as re-accumulation before the next upward impulse, with targets set around $4,100–$4,150.

Gold Forecast Summary: Scenarios for the Week Ahead

The upcoming week will likely revolve around inflation numbers, Fed commentary, and political developments in Washington.

If Core CPI or PPI readings fall below expectations, it could reinforce the Fed’s dovish stance and give gold the push it needs to test new highs.

Conversely, stronger inflation data may temporarily lift the U.S. dollar and trigger a pullback toward $3,950–$3,920.

Traders should also monitor ETF inflows, bond yield direction, and the CME FedWatch Tool’s rate-cut probabilities for short-term trading cues.

| Scenario | Key Catalyst | Likely Outcome |

|---|---|---|

| Bullish | CPI softer than expected | Break above $4,100 → next target $4,150 |

| Neutral | Mixed inflation readings | Range-bound trade $3,970–$4,060 |

| Bearish | CPI > 0.4% MoM | Pullback toward $3,950 support |

Technical Levels for the Week

| Type | Level | Description |

|---|---|---|

| Resistance 2 | $4,150 | Bullish extension target |

| Resistance 1 | $4,075 | All-time-high retest |

| Pivot Zone | $4,000 | Psychological level |

| Support 1 | $3,970 | Channel and EMA50 support |

| Support 2 | $3,920 | Swing-low and retracement zone |

Trade Idea (For Educational Use Only)

| Bias | Entry | Target (TP) | Stop-Loss (SL) | Comment |

|---|---|---|---|---|

| Buy on Dips | $3,975 | $4,075 / $4,120 | $3,940 | Trend remains bullish; pullback buying favored |

| Breakout Buy | $4,080 | $4,150 | $4,030 | Confirmed breakout above resistance |

| Scalp Sell | $4,120 | $3,990 | $4,145 | Counter-trend short near ATH |

Conclusion

Despite short-term noise from U.S. politics and delayed economic releases, gold’s underlying trend remains strong and data-dependent.

The combination of a softening U.S. dollar, declining yields, and persistent safe-haven interest suggests dips will continue to attract buyers.

Unless macro data dramatically shifts sentiment, the path of least resistance for gold remains upward, with $4,100–$4,150 as the near-term target zone.

FAQs: Gold Weekly Forecast – October 2025

1. Why is gold still rising above $4,000 despite being overbought?

Gold (XAU/USD) continues to climb because strong safe-haven demand, central bank buying, and expectations of further Fed rate cuts are outweighing overbought technical readings. Investors view gold as a reliable hedge against inflation and policy uncertainty, especially during the ongoing U.S. government shutdown.

2. How does the U.S. government shutdown affect the gold market?

The shutdown delays key economic reports such as the Consumer Price Index (CPI) and Producer Price Index (PPI), creating uncertainty around the Federal Reserve’s next move. This lack of clarity often boosts gold prices, as traders shift toward assets less sensitive to policy risk and political deadlock.

3. What are the key support and resistance levels for gold this week?

Technically, support lies at $3,970–$3,950, where buyers are likely to defend the trendline and 50-day EMA. On the upside, resistance appears near $4,075–$4,150, which represents the all-time high zone and next breakout target for bulls.

4. Could the upcoming U.S. inflation data trigger a correction in gold prices?

Yes, a stronger-than-expected core CPI or PPI reading could increase chances of slower Fed rate cuts, strengthening the U.S. Dollar and triggering a short-term correction in gold. However, if inflation data is soft or delayed, gold could maintain momentum above $4,000.

5. Is the overall gold trend still bullish?

Yes — the broader trend remains strongly bullish. Even though gold is consolidating below its peak, technical structure, EMA50/EMA200 alignment, and consistent inflows into gold ETFs suggest that the uptrend remains intact for the medium term.

6. What trading strategy suits gold traders this week?

Traders may consider a buy-on-dips approach, targeting $4,100–$4,150 if prices rebound from the $3,970 zone. A conservative stop-loss around $3,945 keeps risk controlled. For short-term scalpers, range trading between $3,970 and $4,070 also offers attractive intraday opportunities.