Gold Weekly Forecast Will XAU/USD break above $4,264 or slide toward key support? Explore this week’s critical drivers, chart levels, and market sentiment.

Introduction

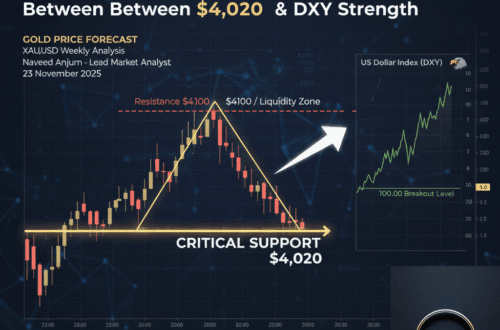

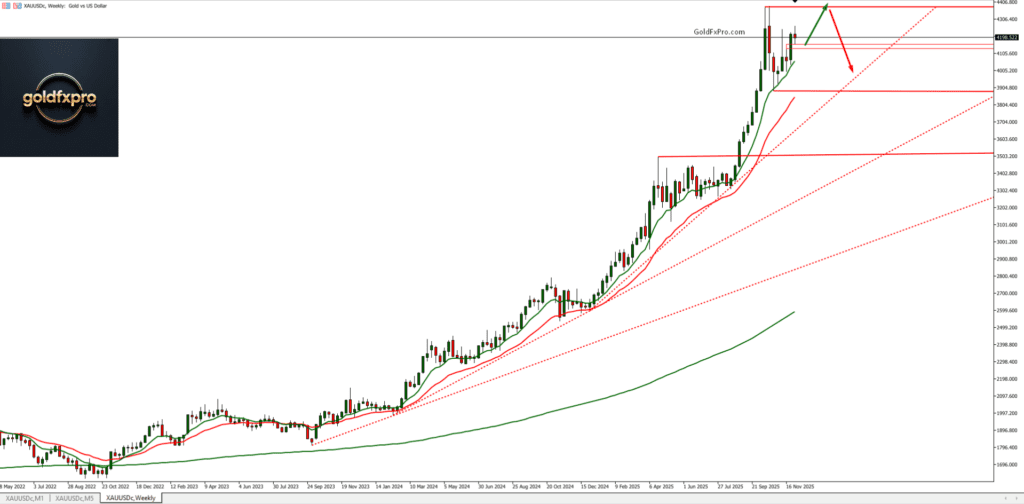

Gold enters the new week in a controlled but tense consolidation, trading around $4,210 as buyers defend the range floor and sellers repeatedly reject attempts above $4,245–$4,264. The market knows a larger move is coming momentum is compressing, volatility is tightening, and liquidity is clustering at the extremes. The question now is whether gold finally breaks the ceiling at $4,264, or whether incoming macro catalysts drag XAU/USD into deeper support.

Latest XAU/USD News & Price Forecast

Gold Market News: Gold Finds Support as Traders Bet on a December Fed Rate Cut Gold Market News: FOMC Minutes and NFP Set the Stage for a Volatile Move in XAU/USD Gold Price Forecast: Fed Rate-Cut Bets Propel XAU/USD Toward the $4,245 Target Gold Price Forecast: Why $4,100 Support Holds Ahead of Crucial US Data 7 Powerful Forces That Move Gold Prices in 2025: A Complete XAU/USD Trader’s GuideFed Policy Remains the Dominant Driver

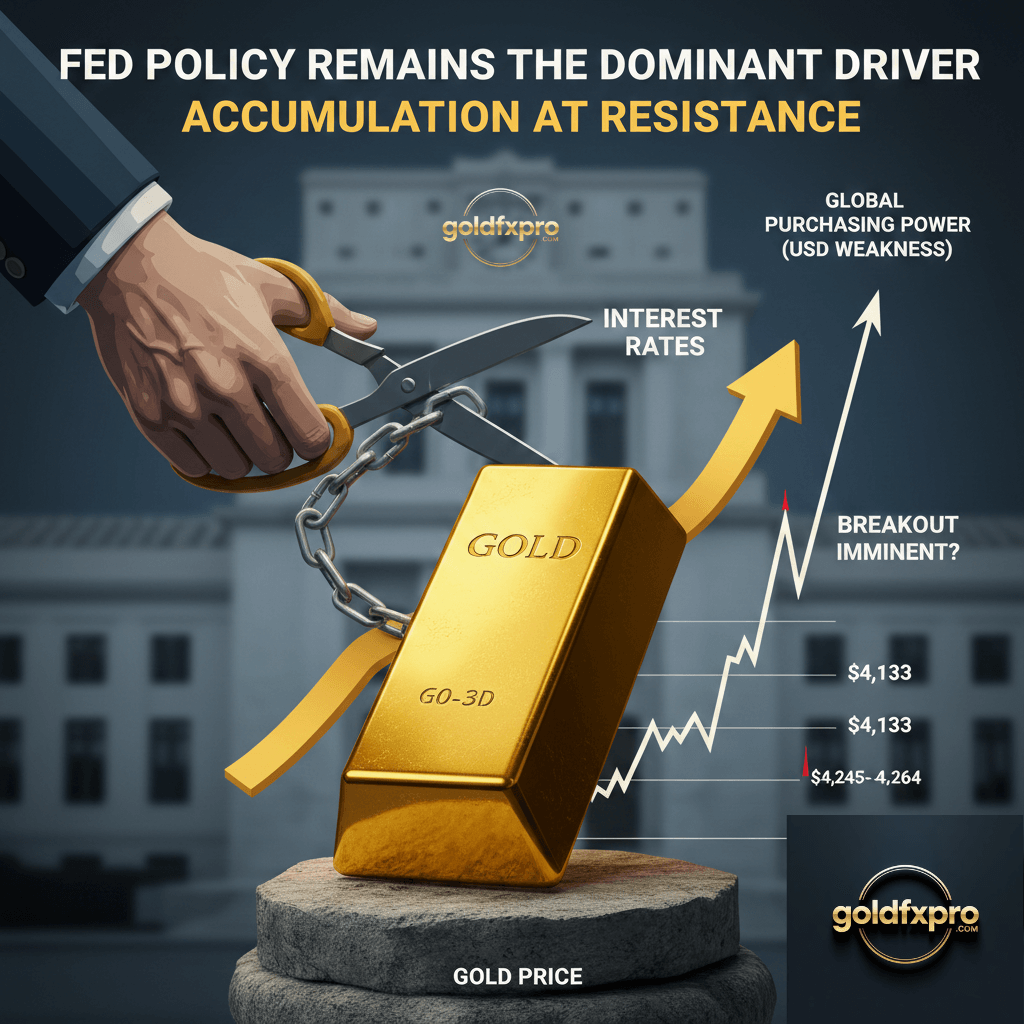

The key force behind gold’s behavior is the market’s conviction that the Federal Reserve will cut rates this week. Futures currently price an 87% probability of a 25-bp reduction. Recent government data shows core PCE easing to 2.8%, signaling softer inflation and strengthening the case for policy easing.

For gold, this backdrop matters for two reasons:

- Declining yields reduce the opportunity cost of holding non-yielding assets.

- A dovish Fed weakens the U.S. dollar, improving global purchasing power for bullion.

Gold is not rallying impulsively not because the bullish narrative is weak, but because traders want confirmation from the Fed before committing fresh capital. The entire Gold Weekly Forecast hinges on whether Powell reinforces or challenges the market’s dovish expectations.

A supportive tone could unlock a breakout. A cautious or hawkish message could force a retest of deeper supports.

Cross-Market Dynamics Dollar Soft Yields Heavy Sentiment Mixed

The U.S. Dollar Index trades near 98.75, unable to mount a meaningful recovery despite mixed labor data. Treasury yields are off their cycle highs, creating a quiet but powerful uptrend driver for gold.

Risk sentiment is split equities lack direction, credit markets are steady, and safe-haven flows are muted. This environment doesn’t create urgency, but it sustains gold at elevated levels without the need for aggressive inflows.In other words gold is holding high ground because nothing in cross-markets argues against it.

Institutional Order Flow Signals Distribution Not Weakness

Despite gold printing its third-highest weekly close ever, order-flow behavior tells a more nuanced story.

Rejection wicks near $4,245–$4,264 show repeated liquidity grabs, not failed rallies. Institutions are probing for stops, not abandoning positions. Buyers remain active on dips above $4,133, while sellers are defending overhead liquidity zones.

This is accumulation at resistance, not exhaustion. But it also means breakout attempts will be violent they must dislodge a significant cluster of resting orders.

Technical Outlook Tight Range High Stakes

Gold trades above the 10-day, 20-day, and 50-day EMAs, maintaining a bullish structure despite slowing momentum. RSI around 60 keeps the market in a controlled uptrend without signaling overextension.

Key Levels Table

| Zone Type | Level | Importance |

|---|---|---|

| Immediate Support | $4,192 | Protects short-term trend |

| Critical Support | $4,133 | Key Fib pivot, heavy buyers |

| Immediate Resistance | $4,245–$4,264 | Liquidity sweep & breakout zone |

| Key Reversal Zone | $4,075 | 50-day EMA and trendline cluster |

Bullish Scenario

If price closes above $4,264, upside opens to:

- $4,300

- $4,345

- $4,381 liquidity zone

The breakout requires a decisive candle, not a wick buyers must demonstrate control.

Bearish Scenario

If gold closes below $4,192, sellers could target:

- $4,164 range floor

- $4,133 key pivot

- $4,075 trend support

Below $4,075, the market shifts from pullback to deeper correction.

Key Levels to Watch

- Immediate Support: $4,192

- Critical Support: $4,133

- Immediate Resistance: $4,245–$4,264

- Trend Reversal Line: $4,075

What Traders Should Track Next

The next 24–48 hours hinge on

- FOMC Rate Decision

- Powell’s Press Conference

- Jobless Claims & Sentiment Data

- Treasury Auctions

Any shift in tone from Powell softer or firmer will dictate whether gold explodes through resistance or sinks back toward trend supports.

Personal Note

From my perspective, the market is behaving exactly how a mature bullish trend behaves slow, defensive, deliberate. Gold is not selling off despite overextended technicals because the macro narrative continues to support long-duration hard-asset exposure. However, complacency is a trap.

The $4,264 zone is not a simple resistance it’s a battlefield of liquidity. Sustainable breakouts occur only when the underlying macro narrative aligns cleanly with technical momentum. Until then, discipline, patience, and scenario-based thinking remain the only rational approach.

What is the Gold Weekly Forecast for this week

Gold remains range-bound between $4,164 and $4,264, waiting for the Fed’s decision to trigger a directional breakout.

Is gold still in a bullish trend

Yes. Gold remains above all major EMAs, though momentum is slowing and resistance at $4,264 must be cleared.

What price level must gold break for upside continuation

A daily close above $4,264 would open upside toward $4,300 and potentially $4,381.

How does the Fed meeting affect the Gold Weekly Forecast

Rate-cut expectations weaken yields and support gold, while hawkish guidance could trigger a pullback.

What is the key support zone for XAU/USD

The most important support sits at $4,133, which aligns with a major Fibonacci pivot and strong historical buyer interest.

Read Pervious Week Forecast