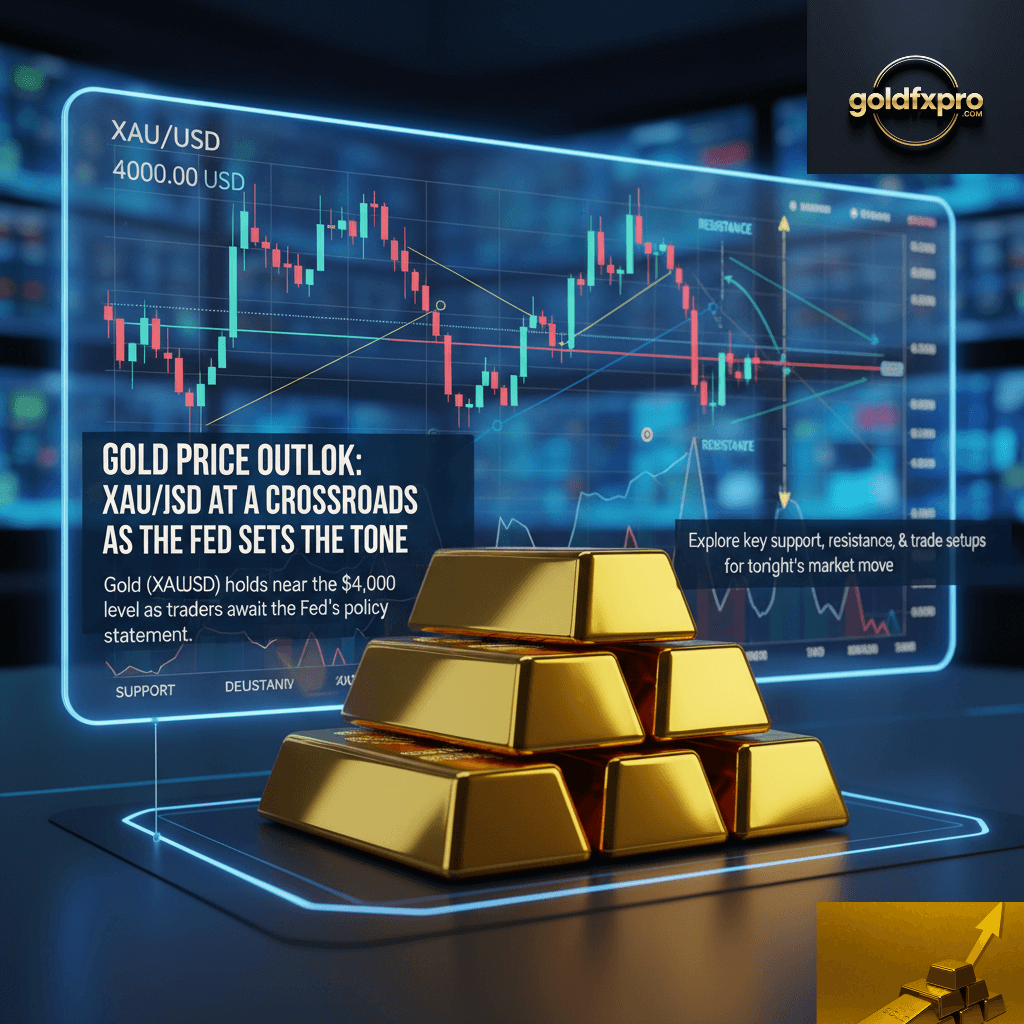

By GoldFXPro | Analyst: Naveed Anjum | Updated: October 29, 2025

Gold (XAUUSD) holds near the $4,000 level as traders await the Fed’s policy statement.

Explore key support, resistance, and trade setups for tonight’s market move.

Overview

Gold prices are back in the spotlight tonight as traders prepare for a crucial Federal Reserve decision that could decide whether the precious metal continues higher or corrects further. Spot gold (XAU/USD) is trading near $3,970 per ounce, slightly below recent highs, as investors weigh the Fed’s rate outlook, the U.S.–China trade narrative, and the broader global economic picture.

Let’s take a look at the key fundamentals driving gold ahead of tonight’s policy announcement and what traders should watch next.

1.Fed Rate Cut and What Really Matters Tonight

All eyes are on the Federal Reserve’s policy statement. Markets are widely expecting a 25-basis-point rate cut, bringing the benchmark rate close to 4.00%. But the real story isn’t the cut itself it’s what Fed Chair Jerome Powell says next.

If Powell hints that more cuts are on the way, the dollar could weaken, boosting gold. But if he sounds cautious or signals a pause, yields may rise, and gold could come under pressure.

According to Reuters, bargain hunting has already helped gold recover some ground, with analysts saying the “fundamental gold story is still valid.” Considering gold’s massive 50% gain this year, tonight’s decision could determine if the pullback is just a pause or the start of a bigger correction.

Source: Reuters – Gold steadies ahead of Fed verdict

2.U.S.–China Trade Optimism vs. Safe-Haven Demand

Another key factor weighing on gold is the renewed optimism around U.S.–China trade talks. Recent reports suggest both sides are close to finalizing a framework deal. That optimism has fueled stock market gains and pulled some money out of safe-havens like gold.

As equities rally, gold’s defensive appeal weakens. Earlier this week, prices slipped below the $4,000 level as investors shifted toward riskier assets. But this tug-of-war between Fed policy (bullish for gold) and trade optimism (bearish for gold) is keeping volatility high.

Source: Reuters – Gold dips as stronger dollar, trade deal hopes weigh

3.The Dollar’s Rebound and Rising Real Yields

The U.S. dollar has started to regain strength after recent weakness, which typically puts downward pressure on gold since it’s priced in dollars. If real yields edge higher following the Fed’s statement, gold could struggle to stay above key support.

Fed officials like Christopher Waller have already hinted that while more easing is possible, the pace could slow down. The Financial Times recently noted that Waller supports further cuts but urges caution because of mixed data a signal that the Fed might not go “all in” on dovish policy.

That uncertainty keeps gold traders on edge tonight.

Source: Financial Times – Fed governor warns against over-cutting rates

4.Technical Picture: Healthy Correction or Warning Sign?

Gold has fallen more than 10% from its October highs, briefly dipping below $3,900 this week. While that may sound alarming, many analysts see it as a healthy pullback within a strong long-term uptrend.

According to The Economic Times, this week’s decline could be setting the stage for accumulation by central banks and long-term investors. Support is seen around $3,850–$3,800, while resistance remains at $4,000–$4,010.

If tonight’s Fed statement turns dovish, gold could easily rebound above that resistance and head toward $4,145 or higher. But if Powell stays cautious, a drop toward $3,800 wouldn’t be surprising.

Source: The Economic Times – Gold price correction and market outlook

5.Central Bank Buying and the Bigger Gold Picture

Despite short-term fluctuations, the long-term fundamentals for gold remain strong. Central banks are still buying, governments are running large fiscal deficits, and investors continue diversifying away from the U.S. dollar.

As Investopedia noted, even with recent declines, “the reasons for holding gold haven’t suddenly disappeared.” That long-term view is what keeps major institutions and sovereign funds interested dips are being treated as buying opportunities, not red flags.

Source: Investopedia – Gold’s long-term support levels and fundamentals

My Thoughts

Tonight could be one of the most important sessions for gold in weeks. The Fed’s tone will decide whether gold resumes its climb or continues to consolidate. For now, the market remains balanced a dovish Fed could reignite momentum, while a cautious stance might trigger more short-term selling.

For smart traders, this is the time to stay alert and wait for confirmation before committing to new positions. The long-term case for gold still looks solid, but short-term volatility is guaranteed.

Stay patient, trade with clear levels, and let the market show its hand first.

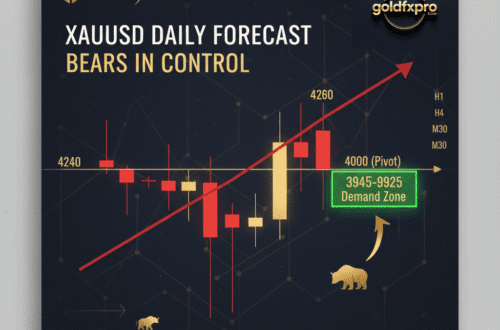

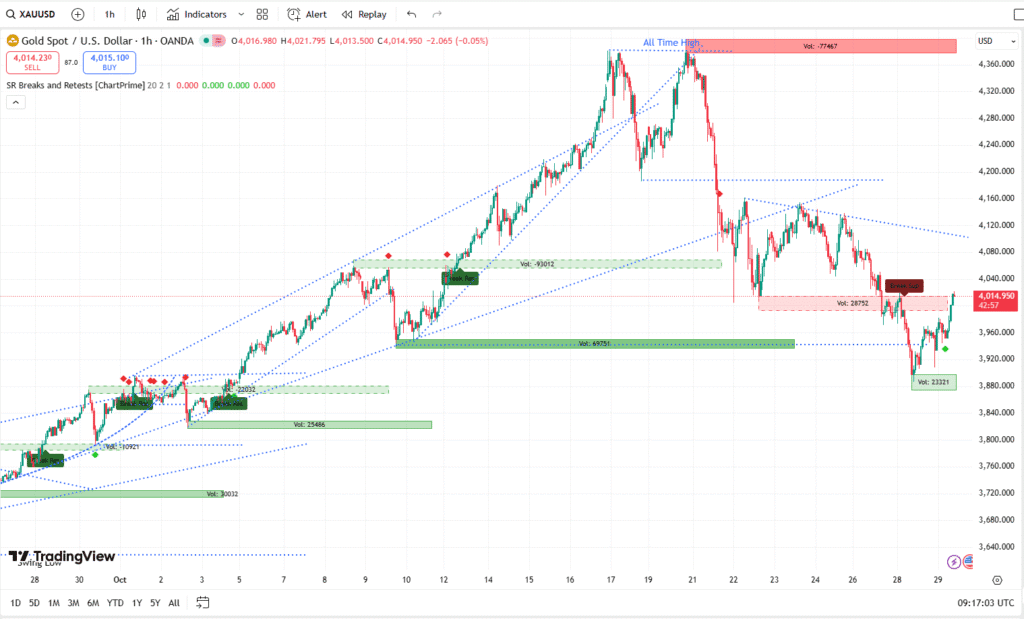

Quick picture (what I see)

- Current price 4,014–4,015 (chart top shows C 4,014.95)

- Price has pulled back hard from the all-time high (4,360 area) and broke the earlier rising channel we are in a corrective phase, but buyers have shown interest around 3,880–3,920 (green volume/support boxes).

- Short-term structure: lower highs since the ATH, with clear resistance between 4,040–4,080 and a higher resistance band near 4,145–4,200. Support cluster around 3,885–3,920 and deeper around 3,750–3,800.

Key Support & Resistance (levels to watch)

- Major Resistance / ATH zone: 4,350 – 4,380 (very strong supply)

- Resistance 2: 4,200 (previous consolidation / dotted line on chart)

- Resistance 1 (near term): 4,145 – 4,160 (next upside target if momentum resumes)

- Immediate resistance zone: 4,040 – 4,080 (important price has stalled here several times)

- Current price / pivot area 4,000 – 4,020

- Support 1 (near): 3,960 – 3,940 (minor demand)

- Support 2: 3,885 – 3,920 (the green accumulation box on chart)

- Support 3 (deep): 3,800 – 3,750 (50% Fibo / big structural support)

Setup A Momentum Long (if price breaks and holds above resistance)

- Plan: Buy a breakout if price clears and closes above 4,050 on the 1-hour (confirm with volume persistent candles.

- Entry: Market buy on confirmed close above 4,050 (or buy limit at 4,045 if you prefer).

- Stop Loss: 4,020 (30 USD below entry if entry 4,050).

- Take Profit 1 (conservative): 4,145 → (95 USD reward).

- Take Profit 2 (extended): 4,200 → (150 USD reward).

- Risk/Reward: TP1 ≈ 3.2R (95/30), TP2 ≈ 5.0R (150/30).

- Why: Breaking 4,050 clears the immediate resistance band and opens the way to 4,145–4,200. Use a trailing stop once TP1 is reached.

Setup B Fade / Short at Resistance (if price rallies into resistance and shows rejection)

- Plan: Short the rejection if price rallies into 4,040–4,080 but fails to break higher (bearish candle rejection or bearish engulfing).

- Entry: Short limit at 4,060 (or market on clear rejection).

- Stop Loss: 4,110 (50 USD above entry).

- Take Profit 1 (conservative): 3,960 → (~100 USD reward).

- Take Profit 2 (ambitious): 3,920 → (~140 USD reward).

- Risk/Reward: TP1 2.0R (100/50), TP2 2.8R (140/50).

- Why: The immediate resistance zone is proven; if price rejects there, the path back to 3,960/3,920 is the most likely short-term move.

Short-term forecast (what I expect tonight / next 24–72 hours)

- Baseline: Neutral to slightly bullish bias if the Fed is dovish. A dovish Powell will likely push the dollar lower and lift gold toward 4,145 then 4,200.

- If Fed is neutral/cautious: Gold may remain range-bound 3,900–4,100 while traders digest clarity. Expect chop and false breakouts.

- If Fed signals restraint (fewer cuts): Dollar strength will likely push gold lower to 3,850–3,800; watch the green accumulation box (3,885–3,920) as the first major buying area.

- In short: tonight’s tone determines whether this pullback is a pause (buy the break) or start of deeper correction (fade rallies and accumulate at 3,800–3,850).

My Personal Thoughts

From my perspective, gold (XAUUSD) is standing at a very critical level around the $4,000 zone. The market has been consolidating for several sessions, waiting for a clear breakout trigger likely tonight’s Fed decision. Technically, if buyers manage to close above 4,050 with momentum, it could open the way toward 4,145 and possibly 4,200 in the next 24–48 hours. However, failure to hold above 4,000 may invite renewed selling pressure toward 3,920 and 3,850.

In simple words I’ll stay cautiously bullish as long as gold holds above 3,940, but a break below that could quickly change the sentiment to bearish. Price action tonight will confirm the next direction; patience and discipline are key right now.

Why is the Fed meeting so important for gold prices

Because interest rate decisions directly affect the U.S. dollar and real yields — two of the biggest drivers of gold.

What happens if the Fed signals more rate cuts

Gold could rally as lower interest rates reduce the dollar’s appeal and boost demand for non-yielding assets.

How do trade talks between the U.S. and China affect gold

Positive progress tends to reduce demand for safe-havens like gold, while rising tensions increase it.

What are the key support and resistance levels for XAU/USD tonight

Support sits around $3,850–$3,800, while resistance is near $4,000–$4,010.

Should traders buy gold now or wait

It depends on the Fed’s tone. A dovish outlook may trigger a bullish move, while a cautious tone might justify waiting for lower entry levels.