By GoldFXPro | Analyst: Naveed Anjum | Updated: October 28, 2025

Gold (XAU/USD) slumped below $3,950 amid easing safe-haven demand as optimism over a potential US-China trade deal lifted market sentiment. Traders now eye the Fed’s policy decision for fresh direction.

Market Summary

| Current Price | Trend Bias | Sentiment | Volatility |

|---|---|---|---|

| US$ 3,906 | Bearish below $3,980 | Risk-Off | High |

Market Overview

Gold extended its decline for a third straight day on Tuesday, touching a three-week low below $3,950 during early European trade. Investors turned risk-on after signs of easing US–China trade tensions, reducing demand for traditional safe-haven assets like gold.

The break below $4,000 marked a key psychological shift, signaling a loss of bullish momentum. The daily oscillators now point lower, suggesting bears remain in control.

Fundamental Drivers

US-China Trade Optimism

Hopes for a trade deal framework between the US and China have brightened market sentiment.

Officials confirmed progress ahead of a potential meeting between President Trump and President Xi Jinping, easing global trade tensions and pressuring gold.

Federal Reserve Rate Cut Expectations

Markets have priced in a 25 bps rate cut at Wednesday’s FOMC meeting, with another expected in December. While lower rates usually support gold, optimism around global trade has offset these tailwinds.

Dollar Weakness & Fed Focus

The US Dollar remains subdued for the second straight day, yet gold’s response is muted as investors await Fed Chair Powell’s guidance for clues on future easing.

Broader Market Sentiment

Global equities advanced amid optimism over trade and dovish central bank expectations.

The Nikkei 225 broke above 50,000, while Mainland China and Hong Kong markets lagged slightly, reflecting investor caution ahead of the Trump–Xi meeting at the APEC Summit.

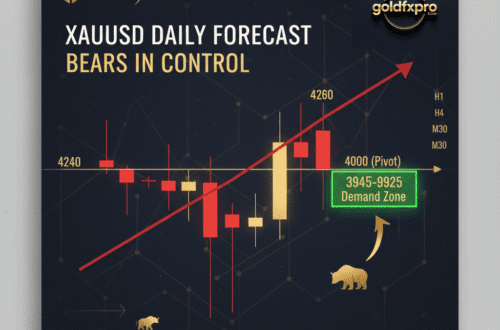

XAU/USD Technical Forecast – 28 October 2025

Market Overview

Gold has broken below the short-term ascending channel and is now testing a crucial demand zone near $3,900–$3,880. Momentum remains bearish after repeated rejections around the $4,040–$4,080 supply zone.

Price action confirms sellers are in control as long as gold trades below $4,000.

Trade Setup Summary

| Plan | Type | Entry (Sell Limit) | Take Profit 1 | Take Profit 2 | Stop Loss | Reward / Risk | Order Type |

|---|---|---|---|---|---|---|---|

| A | Aggressive | 3,920 – 3,935 | 3,850 | 3,830 | 3,985 | 1.3 – 1.7 | Sell Limit |

| B | Conservative | 3,975 – 3,990 | 3,850 | 3,830 | 4,020 – 4,035 | 2.5 – 4.0 | Sell Limit |

Trade Logic

| Observation | Details |

|---|---|

| Trend Structure | Short-term downtrend confirmed after channel breakdown. |

| Resistance Zones | 3,920 – 3,935 (minor) · 3,975 – 3,990 (major / psychological $3,980). |

| Support Zones | 3,850 – 3,830 · 3,800 · 3,740. |

| Invalidation Level | Break and close above 4,035 – 4,050 (H1/H4) = bearish bias invalid. |

| Market Behavior | Sellers defending rallies · Volume rising on down-moves · Momentum favors short setups. |

Risk & Position Management

| Parameter | Guideline |

|---|---|

| Risk Per Trade | 0.5 % – 1.0 % of account equity. |

| Max Exposure | ≤ 2 % total risk across gold positions. |

| Lot Sizing Formula | Lot = (Risk $) ÷ (SL in USD per lot). |

| Example | $10,000 × 1 % = $100 risk → If SL ≈ $58 per 0.01 lot → ≈ 0.017 lot. |

| Trade Management | Move SL to breakeven after ~50 % to TP1 · Partial close 50 % at TP1 · Let rest run to TP2. |

Key Watchpoints

| Factor | Impact / Action |

|---|---|

| Fed Speeches / US Data | Can trigger volatility → pause entries before major releases. |

| Price Above $3,990–$4,000 | Shift bias to Buy side (counter-trend only if confirmed H1 close). |

| H4 Close Above $4,050 | Invalidate bearish setup → exit remaining shorts immediately. |

Summary

- Bias: Short-term Bearish below $3,980

- Strategy: Sell rallies into resistance zones (3,920–3,935 and 3,975–3,990)

- Targets: 3,850 → 3,830

- Stop Loss: Strict above 3,985 / 4,035

- Volatility: High → use tight money management

Personal Thoughts

Today, gold remains under selling pressure below the $3,940–$3,950 resistance zone.

I expect short-term weakness to persist unless bulls reclaim $3,980 with strong momentum.

Overall, I’m watching for another bearish leg toward $3,850 before any meaningful rebound.

Why is gold price falling below $3,950?

Gold dropped amid optimism surrounding a potential US-China trade deal that reduced safe-haven demand.

How does the Fed rate cut impact gold?

Rate cuts typically support gold by lowering real yields, but current risk-on sentiment is offsetting that effect.

What are key support levels for gold now?

Immediate support lies at $3,945, followed by $3,900 and $3,775.

Could gold rebound above $4,000 soon?

A dovish Fed statement or weaker U.S. data could trigger a rebound toward $4,100.

What’s the short-term outlook for XAU/USD?

The trend remains bearish below $4,050, with potential consolidation between $3,940 and $4,050 ahead of major events.