Learn how to read XAUUSD charts like a pro with this complete guide on candlesticks, timeframes, support/resistance, and a 3-step trading system. Perfect for beginners and pros.

At GoldFXPro.com, we believe that every successful gold trader starts with one core skill reading the XAUUSD chart like a professional. It’s not about complicated indicators or fancy software. It’s about seeing the market clearly understanding direction, momentum, and turning points before they happen.

This comprehensive guide breaks down everything you need to know in simple, easy-to-understand English. No jargon. No confusion. Just practical, actionable insights that give you real confidence in the fast-moving world of gold trading.

Whether you’re a beginner just starting out or an experienced trader looking to sharpen your edge, this article will walk you through candlesticks, timeframes, support and resistance, and a step-by-step reading system all tailored specifically for XAUUSD (gold vs. US dollar).

Let’s begin.

Why Learning to Read XAUUSD Charts Is Your Greatest Advantage

Gold isn’t like stocks or forex pairs. It moves with emotion, liquidity, and global events sometimes violently.

One minute, price is surging on safe-haven demand. The next, it’s crashing on a strong dollar or Fed announcement.

If you can’t read the chart, you’re always reacting after the move.

But when you truly understand the chart, something changes

That’s the difference between trading like a professional and gambling like a beginner.

At GoldFXPro.com, we’ve seen thousands of traders transform their results simply by mastering chart reading. And today, we’re giving you the exact roadmap.

You stop guessing. You start seeing. You enter with clarity. You exit with control.

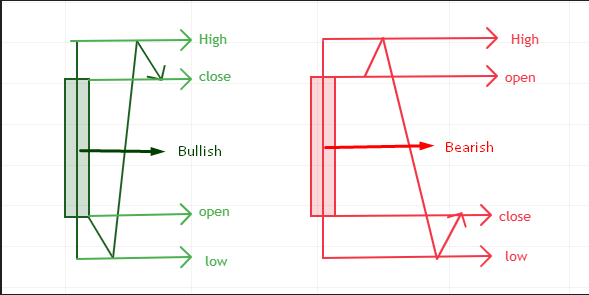

1.Understanding Candlesticks The Heartbeat of XAUUSD Price Action

Every candlestick on your XAUUSD chart is a mini-battle between buyers and sellers.

It’s not just a red or green bar. It’s a story.

Each candle shows four critical prices:

| Part | Meaning |

|---|---|

| Open | Where price started |

| High | Highest point reached |

| Low | Lowest point reached |

| Close | Where price ended |

But the real power comes from interpreting the shape and emotion inside the candle.

Types of Candlesticks Every Gold Trader Must Know

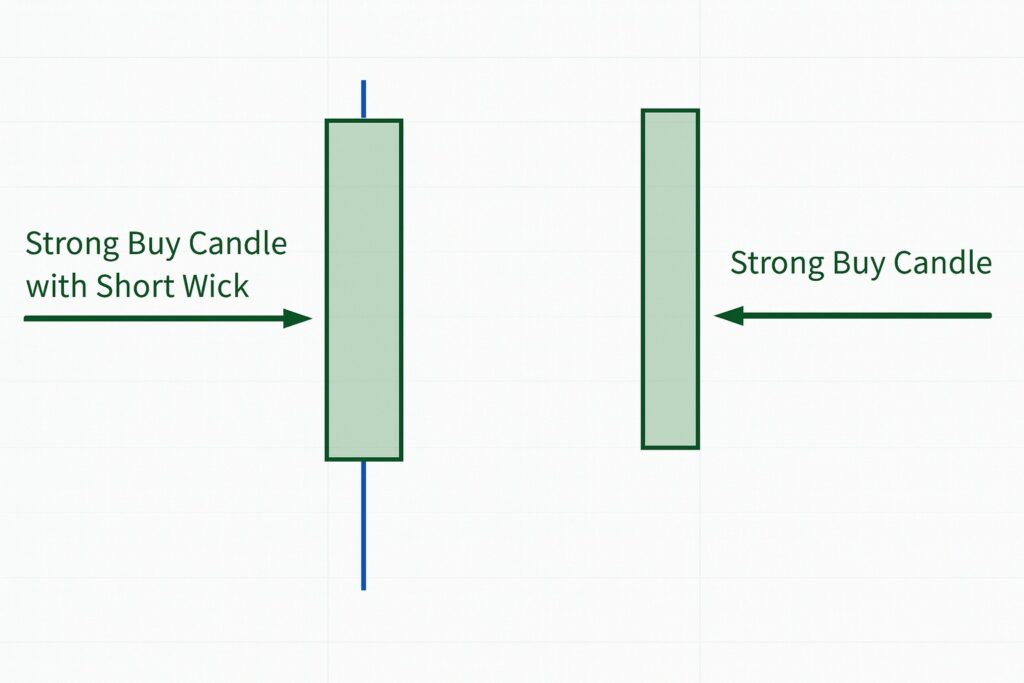

Strong Bullish Candle

- Long green body

- Little or no upper wick

- Meaning Buyers dominated from open to close. Momentum is strong.

Imagine the relief in a trader’s heart when they see this after a pullback hope turns into conviction.

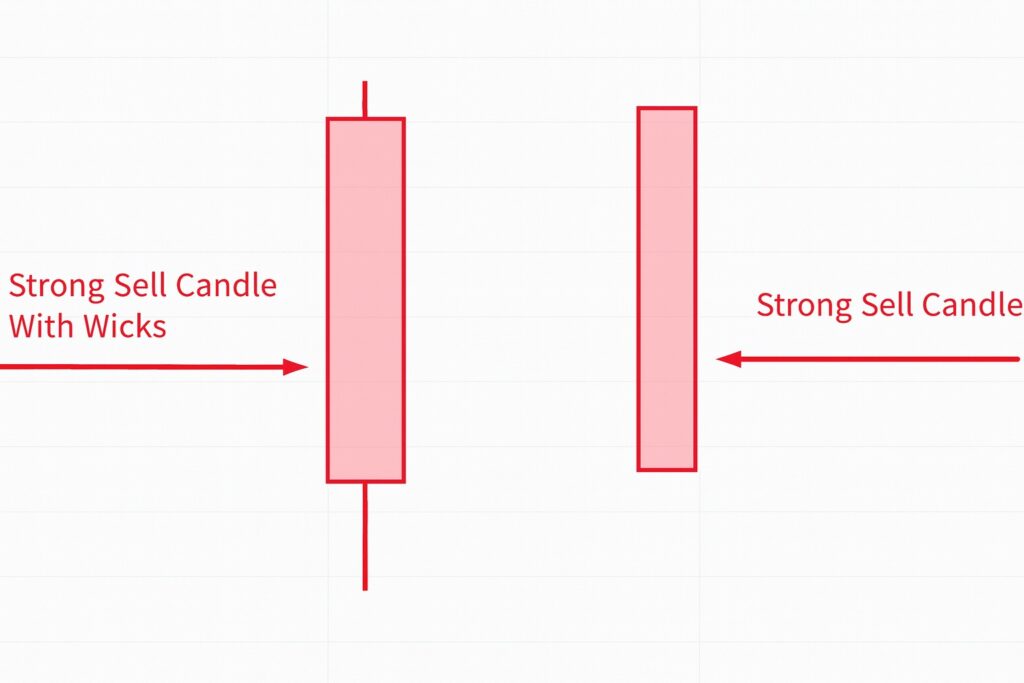

Strong Bearish Candle

- Long red body

- Little or no lower wick

- Meaning Sellers took full control. Bears are in charge.

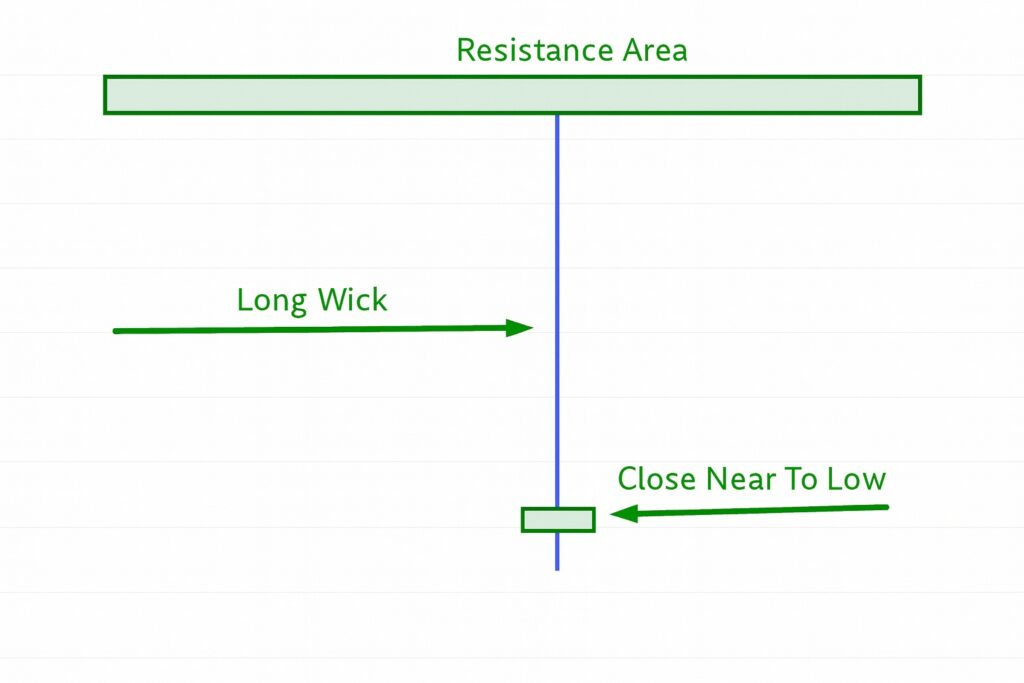

Long Upper Wick (Rejection Candle)

- Price spiked high… but closed near the low

- Meaning Buyers tried to push up, but sellers rejected the move aggressively.

This is where smart traders wait. A long upper wick at resistance? That’s a potential reversal signal.

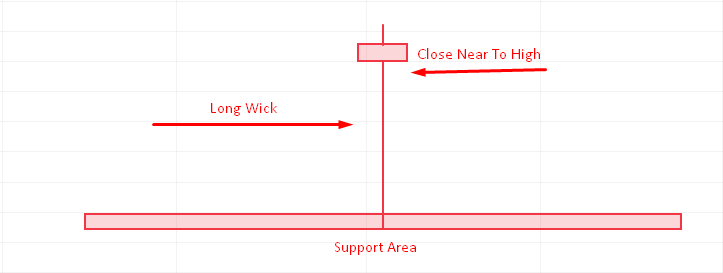

Long Lower Wick

- Price dropped sharply… but closed near the high

- Meaning Sellers pushed down, but buyers fought back hard.

Doji / Indecision Candles

- Tiny body, long wicks on both sides

- Meaning Market is confused. A decision is coming.

Professionals never trade in the middle of indecision. They wait for confirmation.

Pro Tip On XAUUSD, wick analysis is gold (pun intended). Gold loves to fake out traders with long wicks before reversing. Learn to read them and you’ll avoid 80% of bad entries.

2. How Timeframes Tell Different Stories in XAUUSD

Think of timeframes like zoom levels on a map.

Zoom out → See the big picture.

Zoom in → See the details.

Using the wrong timeframe is like navigating London with a world map. You’ll get lost.

Here’s how each timeframe serves a purpose in XAUUSD trading:

| Timeframe | Best For | What It Shows |

|---|---|---|

| M1 / M5 | Scalping, precision entries | Micro-moves, liquidity grabs, order flow |

| M15 / M30 | Intraday structure | Clear trends, pullbacks, session highs/lows |

| H1 / H4 | Trend & key levels | Real direction, major support/resistance |

| Daily | The “Boss Chart” | Long-term trend, monthly liquidity, big-picture zones |

The Golden Rule of Multi-Timeframe Analysis

Beginners do the opposite. They open M5, see a “breakout,” jump in—and get stopped out by a Daily resistance zone they never saw.

Always start from the Daily chart. Then zoom in.

Professionals? They check Daily first. Then H4. Then H1. Only then do they drop to M15 or M5 for entry.

This is called top-down analysis and it’s non-negotiable for consistent XAUUSD profits.

3. Support and Resistance: Where Gold Breathes, Pauses, and Reverses

Support and resistance are not random lines.

They are psychological battlegrounds where:

- Big players defend positions

- Stop-losses cluster

- Liquidity pools form

In XAUUSD, these levels are incredibly reliable because gold respects structure.

How to Identify Support and Resistance on XAUUSD

- Look for swing highs and lows

→ Where price reversed sharply before - Mark zones, not lines

→ Price rarely hits an exact level. Use zones (e.g., 2650–2655) - Check multiple timeframes

→ A level strong on H4 and Daily? That’s a high-probability zone - Watch for repeated reactions

→ The more times price respects a level, the stronger it becomes

Types of Key Levels in Gold Trading

| Level Type | Example | Why It Matters |

|---|---|---|

| Previous Day High/Low | 2680 (yesterday’s high) | Intraday targets |

| Round Numbers | 2600, 2700 | Psychological barriers |

| Swing Points | Last week’s low at 2632 | Major support |

| Trendline Touch Points | Price bounces 3x off uptrend | Dynamic support |

Real Example:

In October 2025, XAUUSD repeatedly rejected the 2700 zone on the Daily chart. Traders who marked this level early shorted the rejection and banked 60+ pips as price dropped to 2640.

That’s the power of clean support and resistance.

4. The 3-Step System to Read Any XAUUSD Chart Like a Pro

This is the exact checklist used by top gold traders at GoldFXPro.com.

Follow it every time you open a chart.

Step 1: Start with the Higher Timeframe (Top-Down Analysis)

- Open Daily chart

→ What’s the trend? (Up, down, ranging)

→ Where are the major levels? - Drop to H4

→ Confirm Daily trend

→ Mark intraday structure - Move to H1

→ Refine levels

→ Look for bias (bullish/bearish)

Never start on M5. You’ll see noise, not signal.

Step 2: Mark Key Zones with Precision

On your H4/Daily chart:

- Draw horizontal zones at swing highs/lows

- Highlight liquidity pools (areas above highs/below lows)

- Note order blocks (last bearish candle before upmove, etc.)

Use color coding:

- Red = Resistance

- Green = Support

- Yellow = Liquidity target

Step 3: Drop to Lower Timeframe for High-Probability Entry

Now switch to M15 or M5.

| Signal | What to Do |

|---|---|

| Pullback to support + bullish candle | Go long |

| Break of structure + retest | Enter in direction of break |

| Rejection at resistance (long upper wick) | Consider short |

Stop-Loss Place just beyond the zone (e.g., 5–10 pips below support)

Take-Profit Next liquidity pool or 1:2+ risk-reward

This system turns chaotic XAUUSD moves into clean, repeatable setups.

5. The Hidden Edge: Emotional Mastery in Chart Reading

You can know every candle, every level, every timeframe…

…but if you panic during drawdown, you’ll still lose.

Gold trading is emotional. It spikes on fear. It crashes on greed.

Here’s how to stay calm and trade what you see, not what you feel:

Emotional Checklist Before Every Trade

| Question | If “No” → Don’t Trade |

|---|---|

| Did I check Daily → H4 → H1? | Yes |

| Is price at a marked level? | Yes |

| Do I have a clear stop and target? | Yes |

| Am I trading the plan, not the emotion? | Yes |

Remember: The chart doesn’t care about your P&L. It doesn’t care about your hopes. It only shows supply, demand, and liquidity, Trade the chart. Not your feelings.

Bonus: Common XAUUSD Chart Reading Mistakes (And How to Avoid Them)

| Mistake | Why It Hurts | Fix |

|---|---|---|

| Trading only M1/M5 | You see noise, not trend | Always start on Daily |

| Drawing thin lines | Price ignores exact levels | Use zones |

| Ignoring wicks | You miss rejection signals | Study wick behavior |

| Fighting the trend | You get crushed | Trade with H4/Daily bias |

| No plan | Emotions take over | Follow the 3-step system |

Final Thoughts: Your XAUUSD Chart Is Your Compass

Reading XAUUSD charts isn’t about memorizing patterns.

It’s about seeing the market for what it is a live battlefield of buyers, sellers, and liquidity.

When you master:

- Candlesticks → You read emotion

- Timeframes → You see context

- Support & Resistance → You know where price will react

- The 3-Step System → You trade with precision

…you stop fearing volatility.

You start welcoming it.

Because now? You’re not guessing. You’re reading.

Start Today:

Open your XAUUSD chart.

Pull up Daily → H4 → H1.

Mark one support zone. One resistance zone.

Wait for price to return.

And trade what you see.

Welcome to professional gold trading.

At GoldFXPro.com, we’re committed to helping traders like you build real skills, real confidence, and real results in the gold market. Bookmark this guide. Share it. Live it.

Your next profitable XAUUSD trade starts with how clearly you can read the chart.

Ready to master XAUUSD?

Join thousands of traders improving daily at GoldFXPro.com your trusted partner in gold trading education.

What is the best way to read XAUUSD charts as a beginner?

Start with top-down analysis: check the Daily trend first, then H4 and H1 for structure. Only after understanding the direction and key levels should you drop to M15 or M5 for precise entries. This prevents confusion and reduces bad trades caused by small-timeframe noise.

Which candlestick patterns work best on XAUUSD?

Gold responds strongly to long-wick rejection candles, strong bullish or bearish bodies, and Doji/indecision candles near key levels. Wick analysis is especially important for gold because it frequently creates liquidity spikes before reversing.

How do I identify strong support and resistance on gold?

Mark zones where price has reversed multiple times, check swing highs/lows, and confirm these areas on higher timeframes like H4 and Daily. Strong levels are those where both buyers and sellers have reacted aggressively in the past.

Which timeframe is most reliable for gold trading?

The Daily chart sets the main trend, while H4 and H1 refine the bias. M15 and M5 are best for timing entries. Relying only on small timeframes leads to false signals, because gold moves fast and often creates misleading micro-patterns.

Why do traders lose money even when they read charts correctly?

Most losses come from emotional trading—entering too early, forcing trades, ignoring stop-loss rules, or chasing price. Even with good analysis, fear and FOMO can ruin execution. A consistent system and emotional control are just as important as technical knowledge.