By GoldFxPro | Published: October 13, 2025 (Updated 09:30 GMT)

Key Points

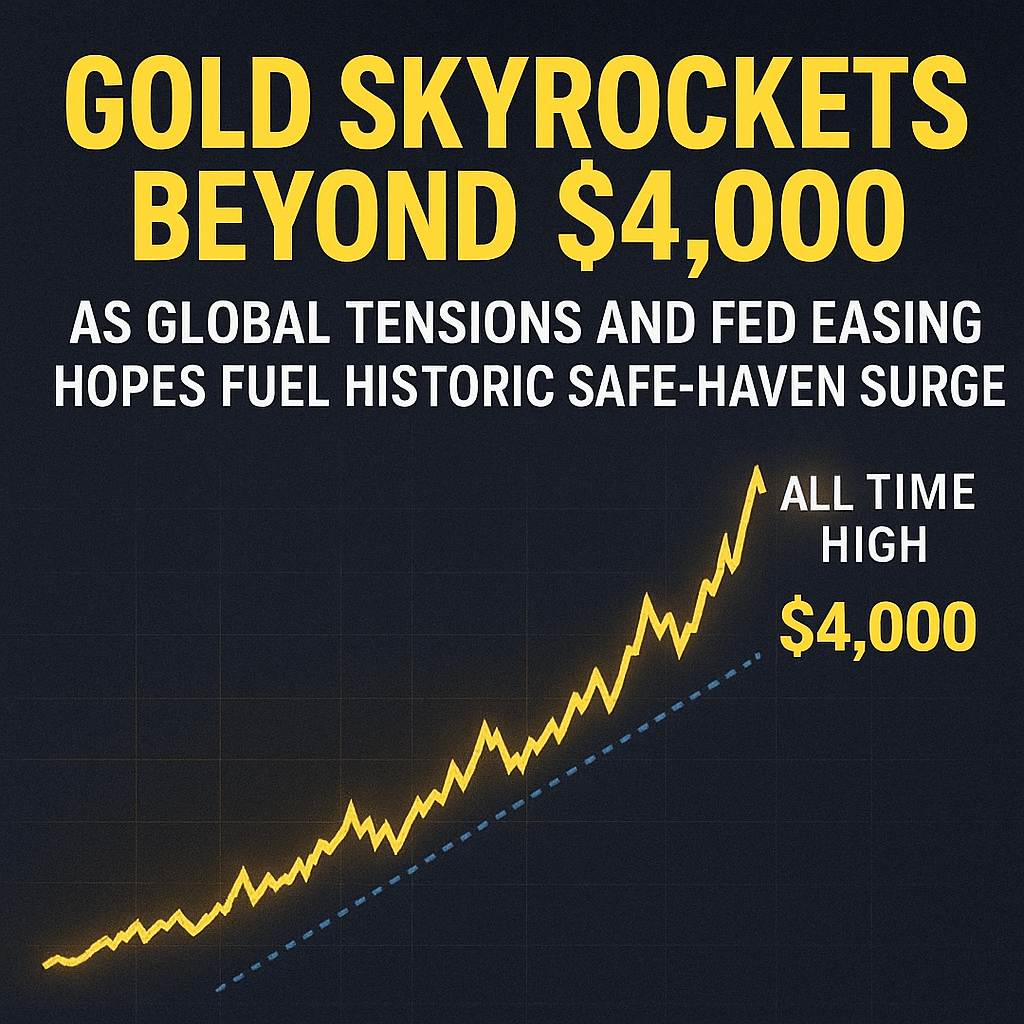

Gold smashes past $4,000 as US-China trade war fears and Trump’s 100% tariff threat ignite a massive safe-haven rush.

Fed rate-cut expectations weaken the U.S. dollar, adding fuel to gold’s record-breaking momentum.

Technical outlook shows key resistance at $4,100 with strong support near $4,020–$4,050 next breakout could define gold’s 2025 trend.

Overview

Gold has just shattered psychological and historical barriers rocketing past $4,000/oz in a dramatic run that few saw coming. The stage is set: an intensifying US-China trade war pumps fear into markets, while whispers of imminent Fed rate cuts undermine the U.S. dollar. Under this pressure cooker environment, gold is no longer just a metal it’s the world’s capital flight lane.

We find ourselves at a crossroads. Is this the start of a sustained gold bull era — or an overstretched, emotionally driven rally ready for a harsh correction? In this article, I unpack the forces behind this surge, map the technical battlegrounds, and share my forecast (with trade levels) from the eyes of a trader who feels this move in his bones.

Gold Extends Record-Setting Rally Amid Renewed US-China Trade War Fears

Markets today live on stress and gold has become the oxygen mask. When Trump threatened sweeping 100% tariffs on Chinese goods, risk aversion went into overdrive, sending capital scrambling toward safety. Meanwhile, Beijing’s escalated export curbs on rare earths and critical materials exposed global vulnerabilities in tech and supply chains. These twin blows ignited a wave of demand for gold, validating its role as the ultimate crisis hedge.

Source: Reuters Gold rose to $4,078 amid trade escalation. Reuters

Trump’s 100% Tariff Threat Sparks Global Risk Aversion

On the heels of renewed trade hostilities, Trump’s sudden announcement of 100% tariffs on Chinese imports (effective Nov 1) coupled with export controls on critical software sent shockwaves across global markets. Equity markets melted, bond yields dropped, and gold soared — the market’s message was clear: “Risk is deadlier than decay.”

See: Reuters coverage of the tariff threat. TradingView

Beijing’s Rare-Earth Export Curbs Deepen Market Anxiety

China answered not with moderation, but force. It expanded controls on rare earths and high-tech materials, adding new licensing requirements and applying dual-use restrictions. Because rare earths power everything from smartphones to missiles, the move struck at the heart of global supply chains — and forced markets to ponder scarcity and security in equal measure. Gold, as the timeless store of value, is reaping the unconscious premium.

Reference: Reuters on rare-earth export steps. Reuters

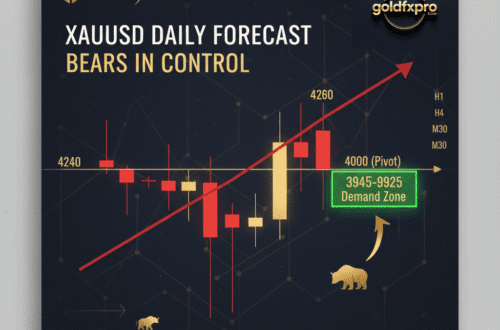

Technical Battle Map & Trade Forecast

(Based on latest chart, timeframe 1H–4H with focus on aggressive tactical moves)

Chart signals & context:

- Gold is pressing resistance at $4,070–$4,100, the zone where many sellers await.

- Underneath lies a curved rising support slope anchoring the rally momentum.

- A clean breakout above resistance could trigger a storm; rejection there may spark a sharp retreat.

Trade Plan (Short-Term):

| Setup Type | Entry Zone | Stop Loss | Take Profit Zones |

|---|---|---|---|

| Breakout Long | On strong close above $4,100 + retest confirmation | Below retest low (≈ $4,070) | TP1: $4,138 TP2: $4,180 – $4,200 |

| Pullback Long | On dip into $4,020–$4,050 with bullish reversal | Below $4,000 | TP1: $4,090–$4,100 TP2: $4,120 |

| Rejection Short | Bearish reversal pattern near $4,100–$4,120 | Above $4,130 | TP1: $4,050 TP2: $4,000 – $3,980 |

Support / Resistance Table:

| Level | Role | Notes |

|---|---|---|

| $4,070 – $4,100 | Major Resistance | All-time high / supply zone |

| $4,138 | Resistance | Upper bound of current ascending band |

| $4,020 – $4,050 | Support | Retest area for broken resistance |

| $3,991 | Support | Lower edge of daily rising channel |

| $3,950 | Support | Psychological & historical cushion |

| $3,895 | Support | Prior swing high / supply zone |

Key triggers & invalidation pointers:

- A confirmed 1H/4H close above $4,100 with momentum & volume will likely open the path higher.

- A bounce from ~$4,020–$4,050 with candlestick confirmation (hammer, engulfing) validates continuation.

- Reversal signals near $4,100–$4,120 (shooting star, pin bar) could flip into a short.

- Break below $3,991 in daily candles would damage the bias and call for reevaluation.

Final Thoughts & Trade Ethos

This is not just another gold spike it’s a statement. The financial world is in flux, and capital is gravitating toward confidence embodied in gold. But emotion runs hot near extremes. A tactical trader must balance conviction with caution don’t get swept up in the mania.

As I watch this unfold live heart pounding, finger on the trigger I believe the trajectory is higher, for now. Yet I remain ready to protect, hedge, or retreat if the winds shift. Use tight risk, validate entries, and never assume permanence.