Overview

Gold (XAU/USD) held steady near record highs on Thursday, trading above the $4,030 per ounce level as investors awaited fresh cues from the U.S. Federal Reserve regarding the path of interest rates. The yellow metal remains supported by dovish Fed expectations, a softer U.S. dollar, and ongoing concerns surrounding the U.S. government shutdown, which continue to drive safe-haven demand. Traders now turn their attention to Fed Chair Jerome Powell’s remarks later today for hints on the timing and scale of upcoming rate cuts that could shape gold’s next major move.

Why Gold Is Holding Near Record Highs

Gold’s remarkable strength this week stems from a blend of dovish Fed expectations, persistent geopolitical uncertainty, and delayed U.S. economic data due to the prolonged government shutdown. Investors increasingly expect at least two rate cuts before year-end, keeping Treasury yields under pressure and boosting demand for non-yielding assets like gold.

Market Movers: Shutdown, Fed Tone, and Geopolitical Updates

Gold’s resilience reflects the complex mix of political and economic crosscurrents shaping global sentiment. The U.S. government shutdown, now in its ninth day, has disrupted key data releases — including Nonfarm Payrolls (NFP) and Weekly Jobless Claims leaving traders with limited visibility on the labor market. The data blackout has intensified uncertainty and shifted focus toward Federal Reserve commentary for policy guidance.

Meanwhile, the U.S. Dollar Index has slipped to multi-week lows, adding further support to bullion. Analysts highlight that with major data missing, Fed statements have become the primary compass for traders gauging the economy’s health. As a result, gold continues to attract steady safe-haven inflows, holding just below its all-time high near $4,059 per ounce.

Adding to the dovish sentiment, New York Fed President John Williams reaffirmed his support for additional rate reductions, citing a cooling labor market and easing inflation pressures. His remarks reinforced expectations that the Fed will maintain a soft policy stance in upcoming meetings.

On the geopolitical front, tentative progress in Middle East peace talks and reduced tensions in Eastern Europe have slightly lowered risk premiums but haven’t diminished gold’s appeal. Analysts maintain that the broader outlook for bullion remains constructive as markets await Powell’s comments later in the day for fresh direction.

Trump’s Tariff Strategy Deepens as U.S. Reaffirms Protectionist Policy

The U.S. government’s renewed tariff strategy underscores Washington’s continued reliance on trade barriers as a central economic and foreign policy tool. President Donald Trump’s late-September announcement introduced a new round of duties Ranging from 25% on heavy trucks to 100% on pharmaceuticals under Section 232, citing national security concerns.

Analysts see these tariffs as a contingency mechanism, possibly activated if the Supreme Court blocks bilateral tariffs in its November 5 ruling. While a modest reduction in duties on European automobiles offers some relief, the overall picture points to a sustained protectionist stance. Economists estimate the effective U.S. tariff rate near 10%, expected to rise toward 20% by the end of Trump’s term, signaling a strategy aimed at both revenue generation and geopolitical leverage. FxStreet

What to Expect from Powell’s Remarks

Investors are bracing for Powell’s much-anticipated remarks today, hoping for clearer insight into whether the Fed will proceed with further rate cuts or adopt a cautious stance amid mixed signals. U.S. equity futures remain muted ahead of the speech as markets weigh inflation risks highlighted in the Fed’s September minutes against growing signs of labor market softness.

With the U.S. government shutdown delaying key data, Powell’s comments may carry even greater weight in guiding market expectations. Recent statements from Fed officials like John Williams have increased pressure on Powell to clarify the central bank’s direction — particularly on the timing and magnitude of future cuts. Traders will be listening closely for any balance Powell strikes between inflation control and employment growth. Reuters

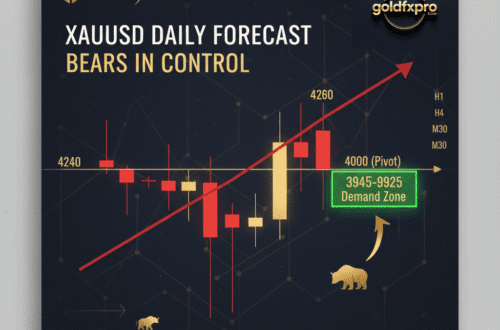

Trading Strategy Ideas: Dip Buyers to Watch

Gold continues to ride a strong bullish wave, but with momentum indicators showing signs of exhaustion, smart traders are shifting toward buying dips instead of chasing breakouts. Live TradingView charts show key support zones forming around $4,000–$4,020, likely to attract buyers if prices retrace.

Technical traders should watch for bullish reversal patterns such as hammer or engulfing candles near those levels as potential long-entry confirmations. A tight stop-loss just below support can manage downside risk, while targets may be placed near recent highs around $4,050–$4,060. In short: patience pays wait for the dip, confirm the bounce, and enter confidently while managing position size wisely. Tradingview

Frequently Asked Questions (FAQs)

1. Why is gold trading near record highs right now?

Gold remains near record highs mainly due to expectations of upcoming Federal Reserve rate cuts, a weaker U.S. dollar, and ongoing safe-haven demand amid the prolonged U.S. government shutdown. These factors together are boosting investor confidence in bullion as a stable store of value.

2. How could Jerome Powell’s remarks affect gold prices?

If Fed Chair Jerome Powell signals deeper or faster rate cuts, gold prices could rise further as lower interest rates reduce the opportunity cost of holding non-yielding assets. However, if Powell takes a more cautious tone, short-term profit-taking may pull gold slightly lower.

3. What key levels should gold traders watch now?

Technical charts show strong support near $4,000–$4,020 and immediate resistance around $4,059–$4,070. A clear breakout above resistance could signal a new record high, while a sustained drop below $4,000 may trigger short-term corrections.

4. How is the U.S. government shutdown influencing gold markets?

The shutdown has delayed key U.S. economic reports, including Nonfarm Payrolls (NFP) and inflation data, creating uncertainty in financial markets. This data vacuum has pushed traders toward safe-haven assets like gold, keeping prices elevated.

5. What trading strategy suits the current gold market?

Given the overextended rally, experts suggest a “buy-the-dip” approach. Traders should look for pullbacks near support zones and wait for bullish confirmation patterns before entering long positions. Risk management with tight stop-loss levels remains crucial.

6. What impact do U.S. tariffs have on gold prices?

Renewed U.S. tariffs under President Trump’s administration have added uncertainty to global trade dynamics. This often benefits gold as investors seek stability amid protectionist measures and rising geopolitical tensions.