Gold (XAU/USD) stays strong above $3,500 as bulls aim for a break toward $3,700. Softer U.S. data, Fed rate-cut expectations, and safe-haven demand fuel optimism for another bullish leg.

Market Summary

| Current Price | Trend Bias | Sentiment | Volatility |

|---|---|---|---|

| $3,560 | Bullish Above $3,500 | Cautiously Optimistic | Moderate to High |

Overview

Gold has been holding firm above the US $3,500 level, and the bulls seem to be gearing up for a push toward US $3,700. With weak U.S. data, safe-haven demand and expectations of easing from the Federal Reserve creating tailwinds, the momentum is in the bulls favour. But reaching US $3,700 and then sustaining it will require several pieces to fall into place. Let’s unpack what’s going on.

Recent Price Action

The spot gold pair (XAU/USD) managed to clear around US $3,500, converting what once was resistance into a support zone. That change in role gives bulls some breathing room. On the upside, the next challenge is near US $3,600, and beyond that lies the key target zone of US $3,700 to US $3,820. As long as the US $3,500 base holds, pull-backs may offer buying opportunities rather than signs of reversal.

Why Are Bulls Targeting US $3,700+?

Here are several factors working in favour of a gold move higher:

- Weak U.S. economic data: Soft indicators for inflation, labour markets and growth tend to weaken the U.S. dollar, which helps gold (since gold is dollar-priced).

- Fed policy expectations: With markets increasingly betting on rate cuts from the Fed, that reduces the opportunity cost of holding gold (a non-yielding asset), making it more attractive.

- Falling real yields: When nominal rates remain high (or stable) and inflation stays elevated, real interest rates drop or go negative a very supportive backdrop for gold.

- Safe-haven and central bank demand: Geopolitical uncertainty and increased reserve buying from central banks further tighten supply/demand dynamics.

- Weaker USD: A softer U.S. dollar makes gold cheaper for non-USD buyers, boosting global demand. That dynamic tends to amplify bullish gold moves.

Together, these suggest that the “path of least resistance” for gold is upward—so long as there are no major shocks to derail it.

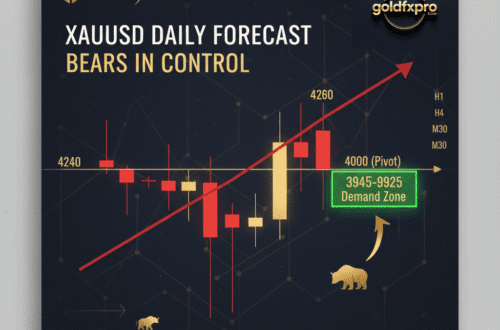

Technical Snapshot: Key Levels

- Support

- US $3,500: Now acting as a major support base, having flipped from resistance.

- US $3,450: Secondary support zone — if the price dips deeper, this is likely the next area of interest.

- Resistance

- US $3,600: Near-term hurdle. Breaking and holding above this could unlock further momentum.

- US $3,700-US $3,820: The next major target zone for the next leg up.

In terms of momentum indicators like RSI: they are showing overbought conditions. That doesn’t mean the rally must end, especially in a strong trend overbought levels can persist. But it does mean caution is warranted around sharp pull-backs or reversals.

Strategy Tip

If you’re trading this move: buying dips above US $3,500 (while that support holds) offers a favourable risk-reward. But once you’re moving into the US $3,600 to US $3,700 zone, you may want to tighten stops or take partial profits. If resistance stalls there, it’s wise to respect the risk of reversal or consolidation.

What to Watch This Week

- Dollar strength & real yields: If real yields go up (or the USD strengthens), gold might struggle.

- U.S. inflation data (CPI, PPI): Higher-than-expected inflation could strengthen the dollar and hurt gold; easing inflation bolsters hopes of rate cuts, favouring gold.

- Fed commentary and meeting outcomes: Any hint the Fed will delay easing could trigger a correction in gold.

- Geopolitical developments: Escalations tend to trigger safe-haven flows into gold.

Can Gold Really Reach US $4,000?

Many analysts believe yes, the move to US $4,000 is within reach given the structural backdrop (central bank buying, safe-haven demand, Fed easing, currency pressures). For example, some institutions have raised their targets toward that range.However, to break and sustain above US $4,000 likely requires one or more of the following:

- Sustained Fed rate cuts (or clear commitment to them)

- A significant breakdown in the U.S. dollar

- A major global shock (economic, geopolitical) driving safe-haven demand

Closing Thoughts

Gold looks to have entered a strong phase. The fact that US $3,500 is holding as a base provides the bulls with a solid launchpad. With both fundamental and technical factors aligned, moving toward US $3,700 (and possibly beyond) is a realistic scenario. But remember: the road upward may be bumpy. For active traders, buying dips above support makes sense; for investors, staying in the trend while managing risk remains key. Stay alert to the incoming data and events.

External Sources for Further Reading

- “Gold, Inflation and Interest Rates: How Do They Interact?” (Focus Economics)

- “Six reasons gold is soaring this year” (CME Group)

- “Gold 2025 Mid-Year Outlook” (World Gold Council)

Why does a weaker U.S. dollar help gold?

Because gold is priced in U.S. dollars. When the dollar falls, gold becomes cheaper for buyers using other currencies, boosting demand. Also, a weaker dollar often goes hand-in-hand with lower real yields, which benefits non-yielding assets like gold.

What role do real interest rates play in the gold price?

Real interest rates (nominal rate minus inflation) are crucial. Low or negative real rates reduce the opportunity cost of holding gold (which earns no yield). When real rates fall, gold tends to perform well.

Could this rally reverse or is it sustainable?

While many structural factors support the rally, risks remain. A surprise hawkish shift by the Fed, a much stronger dollar, or easing geopolitical tensions could trigger a pull-back. Some analysts caution that the rally may pause or consolidate before another leg.

What would it take for gold to clear US $3,700 and move higher?

Key requirements include: continued weakness in U.S. economic data, firm commitment from the Fed to cut rates, further softness in real yields, a sustained weaker dollar, and/or a new safe-haven event (geopolitical shock). If multiple of these align, US $3,700 becomes more likely.

If I’m a trader or investor, what should I do now?

Traders: Look for dips toward support (near US $3,500) as buying opportunities, but be cautious around resistance (US $3,600-US $3,700). Use stops and manage risk. Investors: If you believe in the trend, maintain exposure but stay disciplined on risk. A pull-back isn’t a reversal necessarily but could be a buying point. Avoid chasing the tip of the move without support.