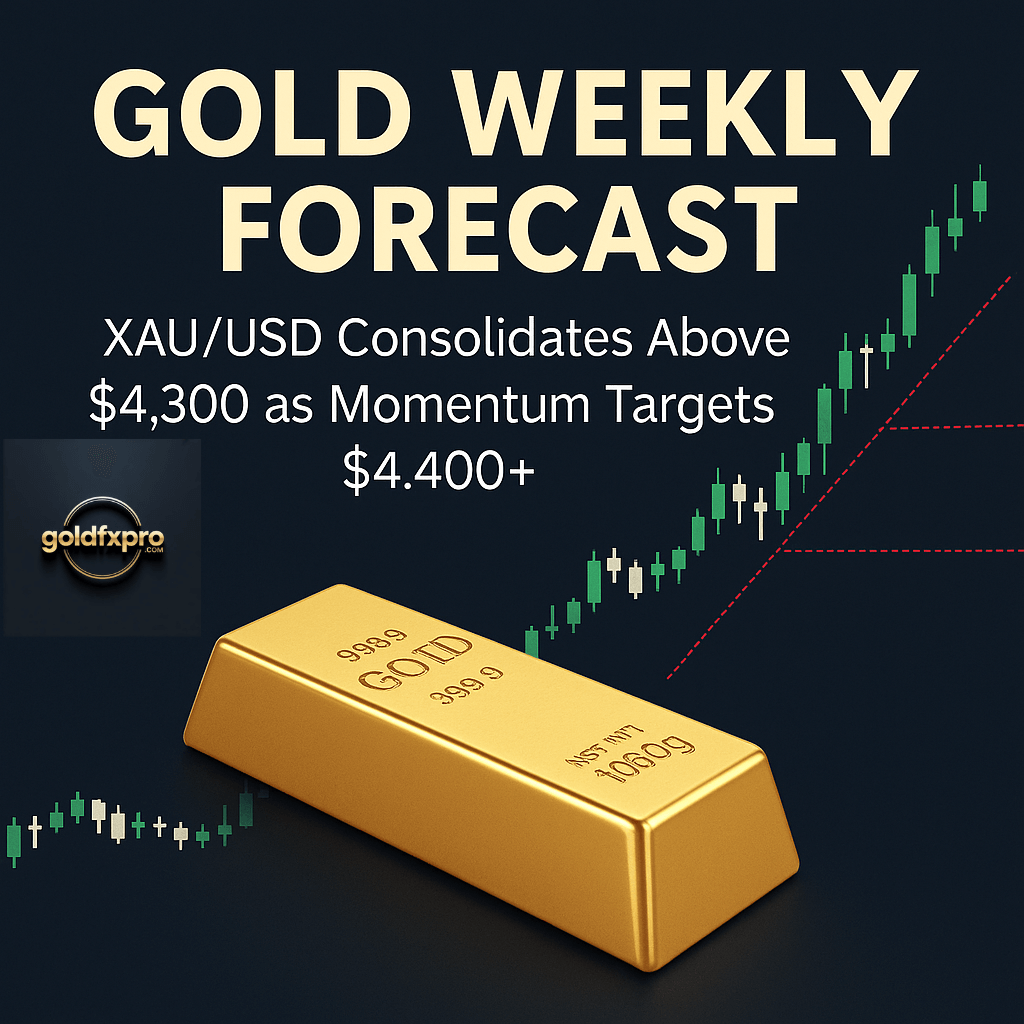

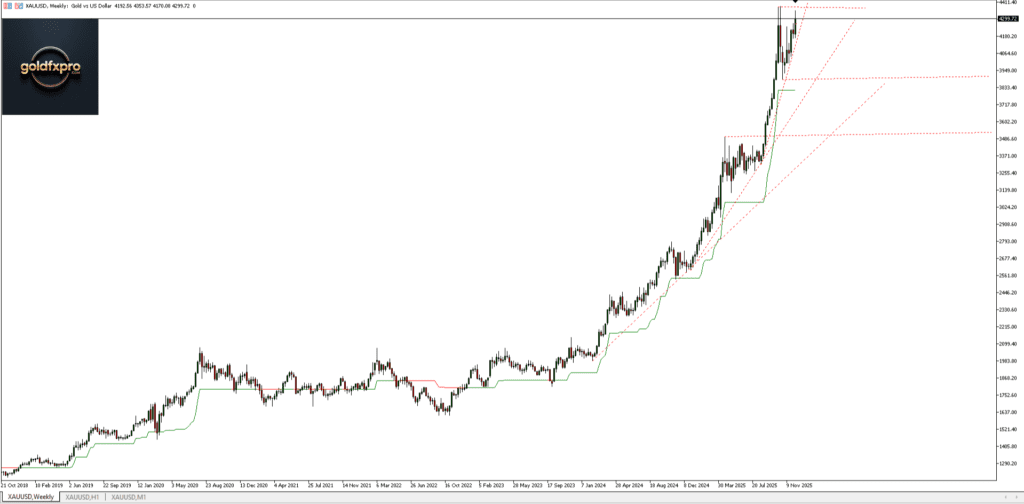

Gold Weekly Forecast, XAU/USD holds firm above $4,300 as bullish structure remains intact ahead of CPI and NFP risk. Explore key support, resistance levels, and Fed-driven outlook shaping gold prices this week.

Gold has shifted into a phase where price action matters more than headlines. After a strong rally toward seven-week highs, XAU/USD is no longer chasing momentum. Instead, it is consolidating above the $4,300 level, signaling acceptance of higher prices rather than exhaustion.

This behavior is important. Markets that intend to reverse usually reject highs quickly. Gold has not done that. It is holding gains, rotating in a narrow range, and maintaining a bullish structure on higher timeframes. That keeps the broader outlook constructive going into the new week.

Price Structure Remains Bullish

From a technical standpoint, the Gold Weekly Forecast remains tilted to the upside. The broader structure continues to print higher highs and higher lows, a sequence that has been intact since the October swing low.

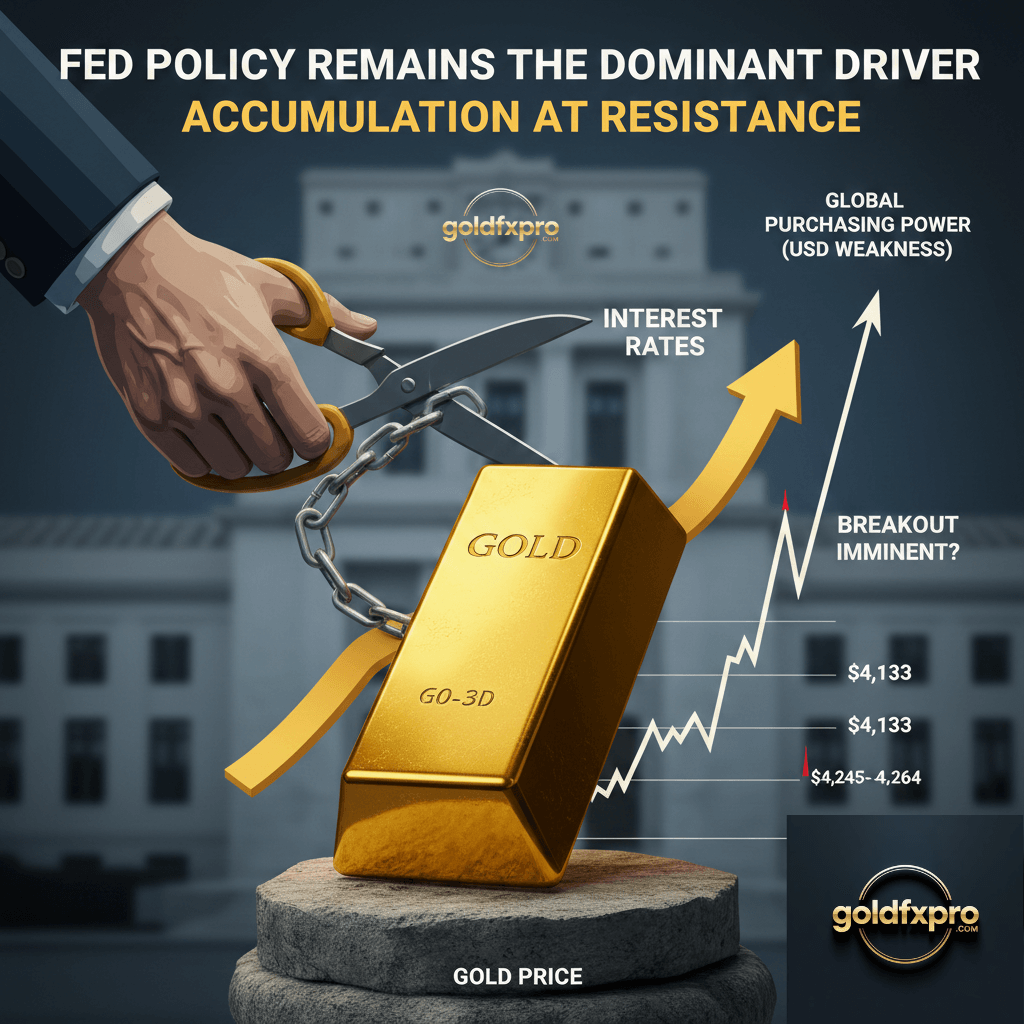

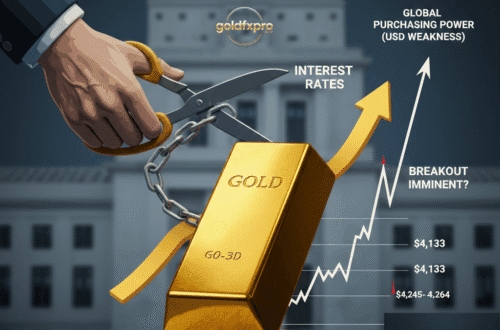

The recent breakout above the $4,245–$4,250 zone confirmed a shift from consolidation into expansion. Since then, price has paused rather than retraced deeply, which often happens when buyers are confident but selective.

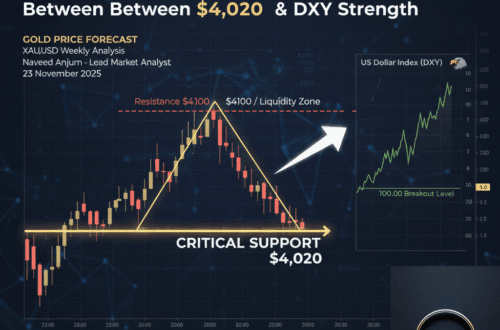

As long as gold holds above the $4,200–$4,175 support band, the bullish structure remains valid. A weekly close below $4,133 would be the first sign that momentum is weakening. Until then, pullbacks are better viewed as corrections within trend, not trend reversals.

Key Levels to Watch This Week

On the upside, immediate resistance remains near $4,328–$4,353. This zone capped the most recent advance and aligns with previous rejection points. A daily close above $4,353 would bring the all-time high near $4,381 back into focus.

A sustained move beyond $4,400 would signal renewed upside momentum and open the door to higher psychological targets. That scenario would likely require supportive macro data or a renewed drop in real yields.

On the downside, initial support sits near $4,285 and $4,250, followed by the $4,200 handle. These areas are technically important because they mark prior acceptance zones. As long as price holds above them, sellers lack confirmation.

Fed Policy and Data Uncertainty Support Gold

Federal Reserve policy remains a key driver behind gold’s strength. While the Fed has already delivered rate cuts, officials remain divided on the pace of future easing. Some policymakers continue to warn that inflation is still elevated, while others are increasingly concerned about labor market softness and distorted economic data.

This lack of clarity benefits gold. When policy direction is uncertain, demand for hedging increases. Gold thrives in that environment, especially when real yields struggle to rise decisively.

Markets are also looking ahead to CPI and Non-Farm Payrolls. Inflation data is complicated by gaps and revisions, increasing the risk of volatility. A softer CPI or weaker labor data would reinforce expectations of further easing and support gold prices. Strong data could trigger short-term pullbacks, but would not automatically invalidate the bullish trend.

Dollar, Yields, and Geopolitics

Despite a recent uptick in US Treasury yields, the US Dollar Index remains subdued. This divergence has allowed gold to stay supported even as nominal yields rise. As long as the dollar remains under pressure, gold retains a structural tailwind.

Geopolitical tensions, particularly around stalled Russia–Ukraine negotiations, continue to provide background support. While not driving daily price action, these risks reduce downside pressure during market pullbacks.

Gold Weekly Forecast Outlook

The Gold Weekly Forecast remains bullish while XAU/USD trades above key structural support. Consolidation above $4,300 reflects strength, not weakness. Bulls remain in control, but confirmation through a break above $4,353 is needed to unlock the next leg higher.

Traders should focus on structure and weekly closes rather than reacting to short-term noise. Gold is repricing expectations, not chasing sentiment. Until that changes, the path of least resistance remains higher.

What is the key support level for gold this week

The key support zone for gold (XAU/USD) lies between $4,250 and $4,200. As long as price holds above this area, the broader bullish structure remains intact and pullbacks are viewed as corrective rather than bearish.

Is gold turning bearish after failing near $4,350

No. The rejection near $4,350 reflects profit-taking, not a trend reversal. Gold is consolidating above $4,300, which suggests strength and acceptance of higher prices rather than distribution.

What resistance levels must gold break to continue higher

The immediate resistance zone sits between $4,328 and $4,353. A confirmed daily close above this area would reopen the path toward the all-time high near $4,381 and the psychological $4,400 level.

How could CPI and Non-Farm Payrolls affect gold prices

Softer inflation or weaker labor data could strengthen expectations for further Fed rate cuts, supporting gold prices. Stronger-than-expected data may cause short-term volatility, but would not automatically invalidate the bullish trend.

What is the overall outlook for gold in the near term

The Gold Weekly Forecast remains bullish while XAU/USD trades above $4,200. Consolidation above $4,300 suggests stability, with upside potential toward $4,400 if resistance levels are cleared.

Read Pervious Week Forecast