By GoldFxPro | Analyst: Naveed Anjum | Updated: October 26, 2025

Gold (XAU/USD) regained strength above $4,100 after softer US CPI data reinforced expectations of a Fed rate cut. Traders eye breakout from consolidation as global uncertainty supports safe-haven demand.

| Current Price | Trend Bias | Sentiment | Volatility |

|---|

| $4,114 | Bullish (but corrective) | Cautiously Positive | Moderate to High |

Quick Insights

- Trend Bias: Overall uptrend remains intact despite a short-term correction after the all-time high near $4,360.

- Sentiment: Traders remain optimistic but cautious, waiting for confirmation above $4,150 or a retest of $4,050.

- Volatility: Price swings are intensifying, reflecting uncertainty ahead of key U.S. economic data next week.

Overview

Gold (XAU/USD) is showing renewed strength above the $4,100 mark after a sharp pull-back from its all-time high near $4,381. With the 4-hour chart now forming a symmetrical triangle, traders are closely tracking upcoming US inflation data and the Federal Reserve policy outlook for clues to the next move.

After setting the record high, gold slipped back but held support and ended the week back above $4,100. The broad uptrend remains intact, but the short-term structure is consolidating as buyers and sellers wait for fresh direction. According to live data, XAU/USD trades around $4,127. Investing.com

Fundamental Outlook: US Inflation, Fed Policy & Geopolitical Tension Set to Drive Gold Next Week

Three big forces will shape gold’s next leg: inflation dynamics in the US, market expectations for further Fed easing, and risk-driven safe-haven demand.

- US inflation & CPI release – The year-on-year CPI report of 3.0% came in a touch below expectations of 3.1%, reinforcing hopes the Fed will follow through on a rate cut. Lower rates tend to strengthen gold’s appeal by reducing the opportunity cost of holding non-yielding assets.

- Fed policy outlook – The market is heavily priced in for a 25-basis-point rate cut at the upcoming Fed meeting, bolstering gold’s bid. But expectations are high and any sign of hesitation could spoil the move.

- Geopolitics & risk appetite – The ongoing US government shutdown, intensifying US-China trade talks, and fresh sanctions on Russia all elevate safe-haven demand for gold.

In simple terms: if events line up with easing policy and risk-on/off pressure remains high, gold stands to benefit. If the data surprises or risk sentiment flips, consolidation or a pull-back could be next.

Traders remain cautious ahead of the September US CPI release, delayed by the government shutdown. Despite recent volatility, underlying support for gold persists due to:

- US Government Shutdown: Now in its 24th day, undermining investor confidence.

- US-China Trade Talks: Scheduled between Presidents Trump and Xi in South Korea next week.

- Geopolitical Risks: Sanctions on Russia’s energy giants Lukoil and Rosneft heighten global uncertainty.

- Interest Rate Expectations: Markets price in a 96% probability of a 25 bps Fed rate cut on October 28–29, with another expected in December.

Lower interest rates reduce the opportunity cost of holding gold, keeping it attractive to investors seeking safety amid economic uncertainty.

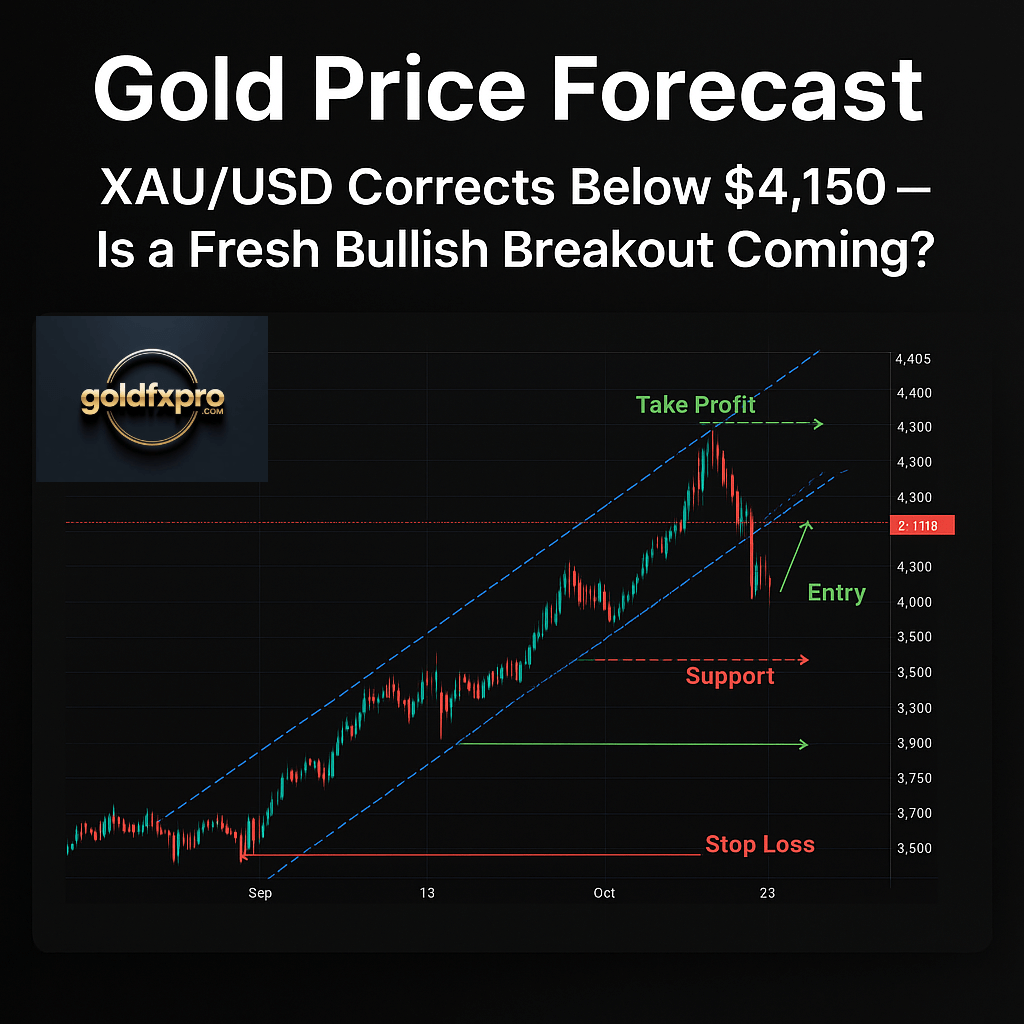

Technical Outlook

Gold is locked in a near-term range between roughly $4,040 (support) and $4,150 (resistance). A breakout in either direction will likely determine the next move:

On the 4-hour chart, momentum indicators are neutral, suggesting the next directional move may be driven by a catalyst rather than pure technical momentum.

Investing.com

Resistance levels: $4,150 → $4,200 → $4,250 → $4,380.

Support levels: $4,100 → $4,040 → $4,003.

XAUUSD (Gold) H4 Forecast(next 1–5 days)

Current (H4) $4,114

Bias > Bullish overall but in a corrective / consolidating phase after the ATH near $4,381.

Timeframe > H4 structure trades horizon short term (intraday to 5 days).

Catalysts to watch: US CPI & Fed meeting expectations, Trump–Xi meeting, US government shutdown headlines.

Technical Summary

- Price recently corrected sharply from ATH; now consolidating inside a shallow rising/horizontal range between $4,040 (lower) and $4,150–4,180 (upper)

- H4 structure shows buyers defending $4,040–4,050 zone (key support). A clean H4 close above $4,150 would resume upside momentum.

- RSI and momentum on H4 indicate cooling price has retraced and needs confirmation to re-accelerate.

- Volatility is moderate→high given upcoming macro events.

Key Levels (Support & Resistance)

| Level | Type | Notes |

|---|---|---|

| $4,380 – $4,381 | Major Resistance (ATH) | All-time-high region — profit taking likely |

| $4,300 – $4,325 | Resistance cluster | Fib/psych level on intraday charts |

| $4,220 – $4,237 | Resistance | Prior swing / 61.8% retrace target |

| $4,150 – $4,180 | Immediate Resistance | Breakout zone — H4 confirmation needed |

| $4,115 – $4,130 | Current Price zone | Intraday pivot |

| $4,056 – $4,044 | Primary Support | 20-day SMA area / intraday demand |

| $4,000 | Psychological Support | Round number / prior swing low |

| $3,945 | Secondary Support | October lows / deeper correction target |

Trade Setup & Plan (1-5 days )

Timeframe: H4 structure, suitable for intraday to 5-day horizon.

Bias: Bullish overall, but caution required given consolidation.

Setup A – Conservative Long (Preferred)

- Entry: Buy limit at $4,044 – $4,050.

- Stop Loss: $3,990 (below $4,000 ‘psychological’ support).

- Targets: TP1: $4,200 | TP2: $4,300 | TP3: $4,380.

- Risk/Reward: Example entry $4,044 → SL $3,990 (risk 54) → TP1 $4,200 (profit 156) → RR ~2.9.

- Strategy: Lean into value near support; reduce size at TP1 and let runner go to TP2/TP3.

Setup B – Breakout Long (Momentum Play)

- Trigger: Clean H4 close above $4,150 – $4,161 (or market entry > $4,170).

- Stop Loss: $4,080.

- Targets: TP1: $4,237 – $4,300 | TP2: $4,380.

- Risk/Reward: Example entry $4,170 → SL $4,080 (risk 90) → TP1 $4,300 (profit 130) → RR ~1.44.

- Strategy: Smaller size given larger risk; require confirmation.

Setup C – Short (If structure fails)

Note: Lower probability given bullish medium-term trend, use small size.

Trigger: Confirmed break & close below $4,040 on 4-hour.

Stop Loss: $4,120 – $4,150 (above retest).

Targets: TP1: $3,945 – $3,900 | TP2: $3,720 – $3,846.

Weekly Forecast Summary

| Indicator | Level | Bias |

|---|---|---|

| Current Price | $4,114 | Neutral to Bullish |

| Weekly Range | $4,040 – $4,150 | Sideways |

| Breakout Zone | Above $4,161 | Bullish |

| Support Zone | Below $4,044 | Bearish |

| Trend Outlook | Consolidation before breakout |

Week Ahead: Key Events

Economic Data: US GDP, Eurozone CPI, China PMI

October 28–29: Fed FOMC Meeting (Expected 25 bps cut)

October 31: Trump–Xi Meeting in South Korea

Major Earnings: Apple, Microsoft, Amazon, Meta, Visa, Chevron

GoldFxPro Analyst Insight

“Gold’s correction looks more like a pause than a reversal. With the Fed poised to cut rates and geopolitical uncertainty rising, the yellow metal remains structurally bullish. A sustained move above $4,150 could quickly re-target the $4,300–$4,380 zone.”

Naveed Anjum, Senior Analyst at GoldFxPro

Sources:

FXEmpire “Gold Price Forecasts & Analysis” FXEmpire

Investing.com “XAU/USD Technical Analysis” Investing.com

MarketScreener “Gold Commodity XAUUSD Summary” MarketScreener

Why did gold fall from record highs?

Profit-taking, easing trade tensions, and a stronger dollar triggered a short-term correction after a nine-week rally.

Is gold still in an uptrend?

Yes, the broader trend remains bullish above $4,000, supported by Fed rate cut expectations and strong central bank buying.

What could push gold higher next week?

A dovish Fed tone, geopolitical headlines from the Trump–Xi meeting, or weaker US data could all lift prices.

Where are the key levels to watch?

Resistance lies at $4,150–$4,200, while support is seen at $4,040 and $4,000.

What is the next big event for gold traders?

The October 28–29 Federal Reserve policy meeting will be critical in setting gold’s near-term direction.